Russians Increasingly Using Assets as Collateral for Loans

In the first half of 2025, the proportion of cash loans secured by property reached 15.5% of the overall volume of personal loans issued. This figure represents the highest level observed for this type of lending over the past two and a half years. According to data from Frank RG, this share has increased by 10% within a year and by 12.2% over two years. Experts discuss the reasons behind the rise in secured lending among Russians and the potential future implications for citizens` financial stability.

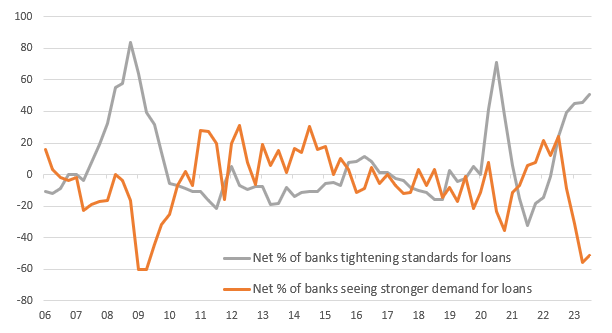

The share of secured loans within the banking sector began to increase in the latter half of 2024. This trend developed concurrently with a decrease in the issuance of unsecured loans. The shift was primarily influenced by the rise in the Central Bank of the Russian Federation`s key rate and the tightening of the regulator`s requirements for retail lending. Consequently, in the first half of the current year, the share of loans backed by assets climbed to 15.5%, marking the highest point since early 2023.

As obtaining unsecured credit became more challenging for borrowers, banks opted to modify their internal strategies and place a greater emphasis on secured lending products. These loans also became more attractive to borrowers themselves, as they frequently offer more favorable interest rates compared to standard unsecured cash loans.

Natalia Milchakova, a leading analyst at Freedom Finance Global, points out that the proportion of overdue debt on loans to individuals is growing in Russian banks, reaching nearly 4.4% of the total retail loan portfolio as of May 2025, according to the Central Bank of the Russian Federation. By expanding secured lending, banks are effectively mitigating the risk of loan defaults. This approach is beneficial for banks because if a borrower fails to meet their repayment obligations, the pledged asset transfers into the bank`s possession. Data from the United Credit Bureau (OKB) for 2024 indicates that 70% of consumer loans secured by collateral were backed by vehicles, while 25% were secured by real estate (it`s important to note this refers specifically to consumer loans with collateral, distinct from mortgages which are always secured by property).

«The rise in the share of loans secured by property is, in my view, linked to high interest rates and the growing debt burden among Russians,» states Igor Dodonov, an analyst at FG Finam. «As a result, to manage increasing credit risks, banks have become more likely to require borrowers to offer some asset as collateral, typically a car or real estate. Furthermore, under stricter macroprudential regulation (measures designed to maintain the stability of the financial system by preventing risks, including loan defaults) from the Central Bank of the Russian Federation, secured loans have a significantly lesser impact on banks` capital, which also appears to have contributed substantially to the growth in the share of these loans.»

For borrowers, secured loans present a complex situation. On one hand, providing collateral can lead to a lower interest rate, and for many individuals, it might be the only feasible option to secure a bank loan. On the other hand, if repayment difficulties arise, there is a considerable risk of losing the pledged asset. The expert cautions that even one`s sole apartment could be lost if used as collateral.

Nevertheless, many citizens who are prepared to pledge property see more advantages than disadvantages in obtaining such loans, according to Milchakova. «These loans are most frequently accessed by borrowers with a less than perfect credit history,» the expert explains. «The drawback for the consumer is the potential loss of a valuable asset in case of default, an asset that could otherwise have generated additional income if sold. Thus, while secured loans are not without their complexities, the general reluctance to lose property suggests that collateral acts as a significant deterrent for individuals with poor credit histories, helping to avert potential bankruptcy and financial ruin.»

However, is there a risk that the sharp increase in secured lending could trigger a financial crisis or negatively affect the public? Experts suggest that the primary risks lie elsewhere. «Currently, I do not foresee any critical threats stemming from the growth in the share of secured loans,» Dodonov commented. He is confident that as the Central Bank`s key rate decreases further, leading to lower loan rates, the proportion of secured loans should gradually return to a more typical level. «Increased secured lending enables banks to mitigate default risks, thus, this practice, in fact, contributes to the financial stability of banks,» Milchakova clarified. She emphasized that, at present, a relatively small number of borrowers are taking out loans with collateral, and the majority of the increase in overdue payments is attributable to unsecured loans.