The Central Bank unveiled several economic scenarios for the country, with the potential for the rate to drop to 7.5% by 2027.

The Central Bank, in its draft Guidelines for Monetary Policy for 2026-2028, maintained its forecast for the average key rate for the current year, expecting it to be within the 18.8-19.6% range. The document also presents three alternative scenarios for Russia`s economic development: «Disinflationary,» «Pro-inflationary,» and «Risky,» in addition to the baseline. These projections were discussed on September 2nd during a press conference led by Alexey Zabotkin, Deputy Chairman of the Bank of Russia.

According to the published materials, the key rate is projected to be between 12-13% next year and could decrease to 7.5-8.5% by 2027.

The «Disinflationary» scenario anticipates a higher return on investment and increased labor productivity compared to the baseline forecast. This would lead to a more rapid reduction in inflationary pressure, allowing price growth to slow with a less stringent monetary policy.

The «Pro-inflationary» scenario accounts for increased budget expenditures on preferential programs, stronger protectionist measures, intensified sanctions pressure, and a drop in oil prices. Under these conditions, the Central Bank would need to implement a stricter policy to curb inflation.

The «Risky» scenario describes an escalation of global economic contradictions, an intensification of trade wars, and a potential financial crisis. However, Alexey Zabotkin emphasized that the baseline scenario remains the most probable.

Currently, the Bank of Russia sees no need for further tightening of its monetary policy. The key rate hike to 21% in the second half of last year proved effective, contributing to a slowdown in price growth. The current policy stringency should be sufficient to achieve the 4% inflation target by the end of 2026. «Price growth rates this year show a systematic and significant deceleration,» Zabotkin noted.

Nevertheless, a premature reduction of the key rate could increase future budget expenditures. If inflation cannot be sustainably curbed, the rate would have to be raised again, making the continuation of state-sponsored preferential programs more costly. «The key rate level directly influences lending and deposit rates, credit growth dynamics, monetary aggregates, aggregate demand in the economy, and the ruble exchange rate,» Zabotkin explained. «All these factors, in turn, determine the extent to which demand from the population and businesses aligns with current production capabilities and future expansion. This relationship then shapes price dynamics in the economy.»

The Central Bank has observed significant progress in its fight against inflation. «Our numerical target is annual inflation close to 4%,» Zabotkin stated. «We consider it possible to lower, but certainly not raise, this target level in the future.» As of the week ending August 25th, annual inflation stood at 8.46% according to Rosstat data, down from 8.79% in July.

Understanding the Economic Paradox

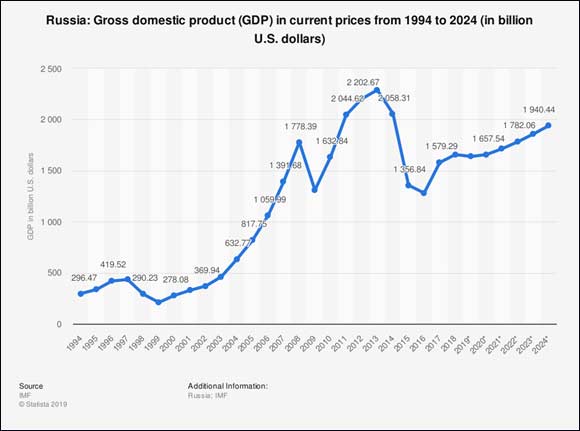

The press conference also touched upon the paradoxes of economic growth in Russia. In 2024, with an average key rate of 17.5%, GDP grew by 4.1%. However, for the current year, with an expected average rate of 16.3–18% (according to the Ministry of Finance`s forecasts), GDP growth is projected at only 1.5%. This raises a question: why did the economy show significant growth, exceeding many forecasts, when the Central Bank maintained a high rate, and then began to slow down as the regulator started to lower it? Businesses had long called for a rate reduction.

«What you`re pointing to is a clear illustration that there is no direct, synchronous, mechanical cause-and-effect relationship between the key rate level and economic growth,» Zabotkin declared in response to the question. «It`s not necessarily true that a lower rate will be followed by a higher real GDP growth rate. This relationship is far more complex and depends on the initial conditions, that is, the conditions in which the economy finds itself at a particular moment.» The Deputy Chairman of the Bank of Russia explained that if an economy is in a state of recession, as it was in the second quarter of 2020 due to the pandemic — marked by high unemployment and low final demand — then a reduction in the key rate, meaning a shift to a softer monetary policy, will stimulate demand and provide an impetus for short-term GDP growth. This would mean that idle resources would be re-engaged in economic activity.

However, if all resources are already utilized, and demand in the economy is very high, as has been the case in Russia for the past couple of years, then the main constraint on future growth is the inability to increase output using available resources because there are simply none. In such a scenario, lowering the rate does not accelerate economic growth, as intuition might suggest, but rather accelerates inflation. «In this situation, a high rate is the Central Bank`s reaction to overheating demand, which increasingly contributes less to future growth and more to high inflation — this is what happened in 2024,» Zabotkin clarified. «Demand was increasingly translating into inflation, and the rate rose in response. The growth slowdown we are currently observing is precisely a reflection of the economy`s difficulty in growing further, due to all resources being utilized as a result of very rapid economic activity in 2023-2024. Demand has already significantly outpaced production capabilities, and as this gap narrows, thanks to a more restrained demand dynamic — including under the influence of the rate hike undertaken by the Bank of Russia last year — we are seeing inflation decelerate. This allows for a reduction in the key interest rate without the risk that this demand overheating will persist and further exacerbate the inflation situation.»