Beijing is ready to approve the construction of a new Russian gas pipeline

The military conflict between Israel and Iran, threatening to disrupt liquefied natural gas (LNG) exports to the Asian market, is prompting China to seek more reliable supply channels for raw materials. To meet its energy needs, Beijing is reportedly preparing to greenlight the construction of the temporarily frozen Russian pipeline project «Power of Siberia — 2».

There is another reason urging Beijing to expedite the creation of this new gas route. Natural gas from Russia will help China, which is grappling with severe air pollution from coal-fired power plants, avert a large-scale environmental disaster.

Consequences of the Iran-Israel Conflict

Although the mutual missile exchanges between Israel and Iran are currently on pause, they have caused significant alarm among major energy buyers. According to The Wall Street Journal, citing sources in the Chinese government, Tehran`s threat to block the Strait of Hormuz, through which approximately 30% of China`s imported gas transits, has led Beijing to consider alternative, secure, and guaranteed suppliers. This situation has prompted Chinese authorities to revisit discussions regarding the «Power of Siberia — 2» Russian pipeline project, which is still in the planning stages but capable of supplying China with the necessary volumes of raw materials.

China`s concern is well-founded. Shipowners have prudently assessed the risks of the escalating situation in the Middle East and are increasingly avoiding transit contracts in the region, reducing the number of available tankers. Consequently, the cost of transporting liquefied natural gas (LNG) has reached its highest point since last autumn: while in 2024, freight rates across the Atlantic and Pacific Oceans dropped below $20 thousand per day, prices now exceed $50 thousand.

Chinese importers immediately reacted to the surge in tariffs, reducing LNG purchases in June to 5 million tons, which is 12% less than a year earlier. According to experts from the Belgian company Kpler, in addition to military actions near the Strait of Hormuz, the main factors prompting China to reduce LNG purchases were an increase in domestic production and stable supplies of natural gas via pipelines from Central Asia (Kazakhstan and Turkmenistan) and Russia.

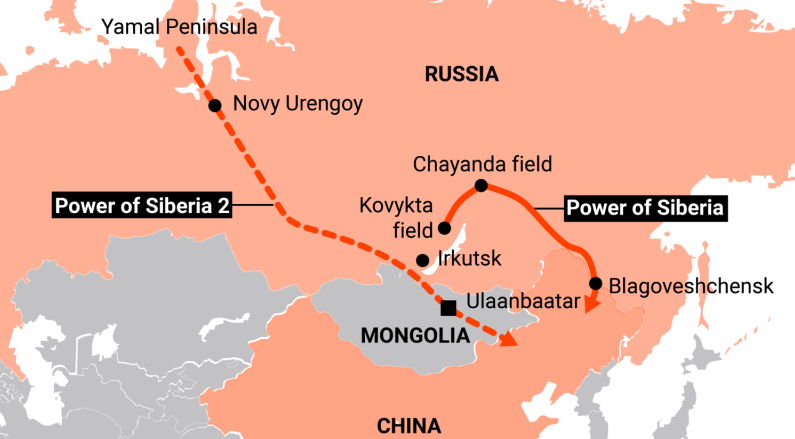

Given the current dynamics, Beijing`s renewed interest in «Power of Siberia — 2» is easily explained. The idea to build this pipeline, which promises to be a logical extension to the «Power of Siberia» gas route commissioned in December 2019, emerged back in the late 2000s. The projected capacity of the second line was set at 50 billion cubic meters, allowing for more than doubling the annual supply of piped gas from Russia to Chinese buyers.

However, despite significant preparatory work, «Power of Siberia — 2» remains merely a project on paper. Market participants believe that the official commencement of construction for the new gas pipeline is being delayed by the Chinese side, which is negotiating for substantial discounts on raw materials. According to Bloomberg, prices for Russian gas supplied to China via this system are expected to be 28% lower than comparable tariffs for Europe, according to the forecast of the Russian Ministry of Economic Development. Such a discount can be considered «lenient,» as Beijing previously insisted on a concession of 37% and even demanded lowering energy costs to the level at which Russian industrial enterprises purchase gas.

Moscow, while undoubtedly interested in the construction of this gas route, is nevertheless not prepared to trade gas at a loss.

Russian Gas — A Helping Hand

According to Sergey Pravosudov, Director General of the National Energy Institute, the changed circumstances in the international political and economic landscape will compel China to compromise on its trade demands and agree to the terms offered by Moscow. The expert shared his view on the situation surrounding «Power of Siberia — 2».

— What are the reasons behind China`s heightened interest in «Power of Siberia — 2»?

— Until recently, that is, until the latest escalation of the conflict between Israel and Iran, international trade cooperation between energy exporters and buyers was largely conducted based purely on economic considerations. We are not talking about Western sanctions against Russia here, which are driven purely by political motives. Primarily, counterparties were competing for the most favorable price for the products being sold. When discussing the prospects and timeline for the start of construction of «Power of Siberia — 2», as well as the details of subsequent gas deliveries via this route, Beijing primarily insisted on a price discount for the raw materials. Now, China`s priorities have shifted towards the stability and reliability of the supply channel.

— Are you referring to problems due to disruptions in energy transportation and even a possible complete halt of tanker passage through the Strait of Hormuz?

— Not only that. A large portion of China`s industrial facilities is concentrated in the coastal zone. Using liquefied fuel is most convenient for them from both a logistical and pricing perspective. The main suppliers of LNG to the global market are the United States, whose relations with China are far from friendly, as well as Australia and Qatar, considered allies of the United States. Beijing understands that there is a risk that all these exporters could suddenly refuse to sell energy resources for reasons, let`s say, unrelated to business – that is, due to geopolitical circumstances, for example, stemming from the struggle between the US and China for global economic dominance.

— Can Russia mitigate such risks?

— Absolutely. Our country possesses the world`s largest natural gas reserves. Domestic producers have proven to be reliable energy suppliers. Furthermore, this year, the operational export pipeline to the east, «Power of Siberia,» is reaching its design capacity of 38 billion cubic meters. China will no longer be able to increase raw material purchases via this route, so Beijing is compelled to consider an additional transportation line for gas supply. Therefore, price disagreements, which previously hindered the progress of the new project, are moving to the background.

— When can we expect a final decision regarding the start of «Power of Siberia — 2» implementation?

— In May, Chinese leader Xi Jinping visited Moscow for the Victory Day Parade. Undoubtedly, during his meeting with Vladimir Putin, the question of the terms and timing for the start of construction of the new pipeline system was raised. In two months, Putin plans to visit China. It is evident that the dialogue regarding accelerating the implementation of this project will be one of the key points on the economic agenda for the negotiations between the Russian President and the Chairman of the People`s Republic of China. We should not forget that Beijing is interested in increasing purchases of Russian gas for very practical reasons as well. Chinese industry is the world`s largest consumer of coal. The use of coal power causes serious harm to nature and the surrounding atmosphere, not only in China itself but also in other countries of the Asia-Pacific region. Many of China`s megacities are on the verge of environmental disaster. In fact, the quickest possible shift from coal-fired industrial enterprises to natural gas is a matter of elementary survival for China. Therefore, there is every reason to believe that the final agreement on all nuances of «Power of Siberia — 2» implementation will occur in the very near future, most likely before the end of this year.