A recently enacted law targeting «droppers»—individuals who facilitate money laundering by providing their bank accounts or cards for illicit transactions—has led to a localized collapse within Russia`s darknet drug market. Reports from sources in the online underground indicate that consumers of illegal substances are facing significant challenges in making purchases. This difficulty stems from the refusal of integrated cryptocurrency exchangers on darknet marketplaces to process small transactions, leaving numerous incoming requests unfulfilled.

«The exchanger isn`t providing payment details,» users have complained on various illicit forums. «Options to top up accounts via bank card or phone number have simply vanished.»

Understanding Cryptocurrency Exchanges on Marketplaces

Darknet marketplaces typically operate on a Bitcoin-only payment system. These platforms host a sophisticated ecosystem of exchange services that pay a fee to list themselves and earn from currency conversions. Common methods for topping up a balance include transferring funds from a personal card to a dropper`s bank details provided by the exchanger, or directly to a phone number. These services impose a commission, which can range significantly, often between 20 to 40 percent of the top-up amount.

A customer support representative for one of the largest marketplaces offered a standard reply to affected users: «Currently, exchangers are issuing details for amounts starting from six thousand rubles. Please try to exchange a larger sum or seek out external exchangers if you can find one that processes smaller amounts. We anticipate the situation will stabilize soon.»

The first clear signs of serious disruption appeared around July 8-9. However, the promised stabilization has yet to materialize, although a few services have started processing slightly smaller amounts, down to four thousand rubles.

The Role of Anti-Fraud Measures Against Phone Scammers

What initially appeared as a minor technical glitch quickly escalated into a major operational hurdle for illegal online platforms. Even independent exchange services, not directly affiliated with the large marketplaces but known to handle «dirty cryptocurrency» (assets stolen from exchanges, or used in illegal activities like darknet purchases, which are flagged in the blockchain and typically rejected by legitimate crypto exchanges), have ceased processing small amounts.

According to representatives of one such exchange, speaking to an influential Telegram channel covering the drug market: «Banks are continuously refining their anti-fraud systems, particularly regarding transfer processing. The entire P2P market (peer-to-peer exchange between individual users, often facilitated by Telegram bots, favored in the darknet for its decentralized and less traceable nature) operates within their oversight. Banks diligently analyze behavioral patterns of participants. Approximately every two to three months, there`s a widespread ban on cards actively involved in P2P operations.»

The exchange clarified that the root cause of the problem is the intensified fight against phone fraud. They added, «Banks don`t differentiate the purpose of a transfer, its origin, or its recipient.» For financial institutions, there`s no distinction between a dropper involved in defrauding citizens and one facilitating drug sales by converting rubles into cryptocurrency.

For amounts of 10,000 rubles or more, problems are virtually non-existent. Dedicated card cascades are utilized for such larger transactions, and these are significantly more resilient.

Representative of an Underground Exchange Service

Dealers Report Significant Drop in Sales

The new law on droppers has particularly impacted small drug vendors selling low-cost, single doses of illicit substances, typically priced at 2,500-3,000 rubles. According to some operators, their business has been almost entirely paralyzed, especially in smaller Russian cities.

«We`re seeing a severe drop in the number of orders,» lamented a representative of a shop with a modest sales network across several Russian regions. «A week ago, only three of our cities were active, but we consistently processed 60-80 orders per day. Now, we have 11 active cities, but we barely manage 20 orders daily.»

«Sales have decreased by at least tenfold, if not more. This has especially impacted shops that sell low-value stashes,» confirmed another dealer. He added that the payment crisis has prompted many Russians to abandon impulsive drug purchases, particularly when under the influence.

The owner of a large darknet drug shop confirmed to Lenta.ru that her colleagues are experiencing «quiet horror» due to plummeting sales. However, she believes that illegal platforms will ultimately adapt and find ways to continue operations. «Cards are blocked very quickly,» she stated. «But banks won`t be able to maintain this pace indefinitely. After all, it also seriously affects ordinary people.»

CIS Droppers as a Potential Solution

The Russian market periodically faces issues with dropper card blockages, which typically lead to fluctuating exchange commissions on illegal platforms or, as seen after the new law, the imposition of minimum transaction amounts.

In response to this, some exchangers have recently begun conducting operations using cards of droppers located outside Russia. They are utilizing bank cards from Tajikistan, Uzbekistan, Kyrgyzstan, and other countries, whose financial institutions allow for easy money transfers from Russia via mobile applications.

«The cross-border channel remains active and has been a lifeline for exchangers even in the most challenging times. The central banks of CIS countries largely rely on the Russian Central Bank in their fight against droppers. However, Russia`s Central Bank alone lacks sufficient resources to effectively control the vast post-Soviet territory, making a complete paralysis of foreign banking details unlikely,» suggested one darknet analyst.

Writing on his Telegram channel, the analyst noted that even the most sophisticated anti-fraud system would be unable to entirely eliminate the cross-border payment channel. Regarding Russian citizens` cards, he hypothesized that the supply of droppers would never dry up, as new individuals continually join the illegal business upon reaching adulthood.

Furthermore, the state objectively takes no social measures to suppress the activities of those who recruit droppers; there are no prominent media campaigns titled `How not to become a dropper.` Simply put, a new article has been introduced into the Criminal Code, but no other preventative measures are being taken.

Darknet Analyst

The analyst concluded by stating that he does not share the widespread panic within parts of the darknet community about the state`s ultimate victory over digital drug trafficking.

Initial Skepticism Regarding the Dropper Crackdown

The law introducing criminal liability for droppers was signed by Russian President Vladimir Putin on June 24, roughly two weeks before the problems for Russian exchangers began. Initially, those involved did not anticipate any immediate or significant changes to their operations.

New Penalties for Droppers in Russia

The document, signed by the head of state, amends Article 187 («Illegal Circulation of Payment Instruments») of the Criminal Code of the Russian Federation. It enables the prosecution of individuals who acquire or transfer their bank cards to fraudsters, whether influenced by them or in exchange for a fee.

Under the new provisions, transferring a personal bank card for remuneration or conducting illegal operations with one`s card at another person`s direction now carries penalties. These include a fine of 100,000-300,000 rubles, forfeiture of income received over three months to a year, up to 480 hours of compulsory labor, up to two years of correctional labor, or up to two years of restricted freedom.

However, if a card is transferred for financial gain to individuals who are not bank clients, the consequences for the dropper become significantly more severe—potentially leading to up to six years of imprisonment and a fine of up to 500,000 rubles.

Criminal liability can only be avoided by droppers who are caught for the first time, actively cooperate with the investigation, and voluntarily identify individuals who committed other crimes using the cards they provided.

The law also introduces penalties for «dropper handlers» (those who recruit and manage droppers). Fraudulent operations conducted with stolen cards or electronic wallets will now incur forced labor for up to five years with a fine ranging from 300,000 to one million rubles, or imprisonment for up to six years with a fine of up to one million rubles.

«I wouldn`t say this bill will entirely shut down payment processing,» remarked a representative of a cryptocurrency exchanger in a conversation with journalists from a darknet-focused Telegram channel. «Selling drugs is also illegal, but the market continues to grow and evolve every year. The more restrictions that emerge, the more workarounds are developed.»

He pointed out that before the increased legal liability, the relevant market, conversely, was actively developing. This was evident in the introduction of new methods for interacting with banks, facilitating cross-border payments, and establishing models involving payments to legal entities` accounts. Nevertheless, the businessman acknowledged that the illicit substances market would face significant challenges in the long term.

«The cost of dropper cards increased exponentially as soon as the first winds of change blew. However, astute plastic sellers already adhere to all security measures, and large traders acquire them from verified sources where demand is scheduled months in advance. Therefore, a decrease in the number of dropper card sellers is unlikely. Often, these cards are issued using falsified documents or even without the knowledge of the actual owners,» explained the exchanger representative.

Drug Dealers Forced to Reduce Spending

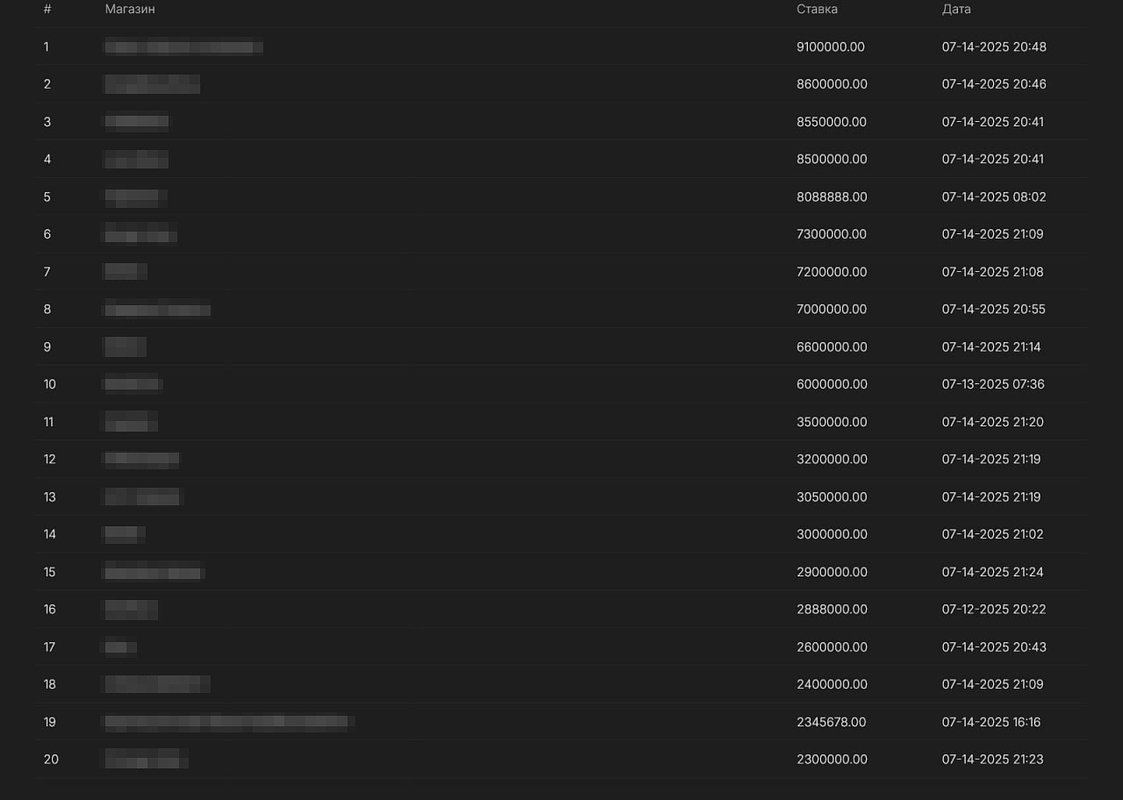

The difficulties experienced in the market were clearly reflected in the results of the auction for prime placement on the main page of one of Russia`s largest darknet marketplaces. Each month, dealers compete by outbidding each other to secure a spot in the top 20, ensuring maximum visibility among users visiting the site. The June auction concluded with a record-breaking result: 20 traders collectively paid 137.9 million rubles for their positions, surpassing the May record of approximately 130 million rubles.

However, July witnessed a substantial decrease in bids. While the June auction`s winner paid 10.1 million rubles for the top position, the same trader achieved the identical result in July with just 9.1 million rubles. Furthermore, the entry threshold for the top 10 in June was 7 million rubles, but in the most recent auction, it plummeted to only 2.5 million. The platform`s total revenue from the auction amounted to 105.1 million rubles, a nearly quarter-reduction (23.76 percent).

Since the last auction, collections have dropped by tens of millions, indicating a serious, though not critical, blow to the market. My expectations for this are somewhat positive. Let`s see how reality unfolds.

Owner of one of the shops that made it into the top 20 after the auction

In a swift response to the situation, the marketplace created its own P2P exchange. This platform effectively allows ordinary users to directly exchange cryptocurrency with each other.

«Literally anyone with a dozen plastic cards can step onto the marketplace and become a trader there. The person facilitating the exchange earns an 11 percent profit and essentially functions as an exchanger,» a darknet analyst explained, detailing the new feature. He added that the marketplace itself stands to earn approximately 24 percent from such exchanges, given an average commission of 35 percent. However, the analyst expressed skepticism about the widespread popularity of this method among traders.

Several anonymous Telegram channels providing legal advice warned darknet participants against utilizing this earning method. They highlighted that while a decentralized exchange system offers some protection to traders, if their activities lead to court, the charges could include not only the acquisition of dropper cards and the legalization of criminal proceeds but also, considering the platform`s nature, complicity in drug trafficking, and in some instances, even membership in a criminal organization.