Blue Fuel Prices Could Jump to $2000

By the end of June, the EU intends to finalize a complete phase-out of Russian gas by 2028. Brussels proposes replacing the resulting energy deficit with imports from other producing regions and alternative fuels. However, these plans may not be practical. Increasingly, EU members are expressing discontent with such an uncompromising measure. Many countries on the continent realize that this anti-Russian political decision will cost hundreds of billions of euros additionally, and not all are able to bear such a financial burden.

Disagreement Among Comrades

The EU`s roadmap for phasing out Russian gas, scheduled for a European Parliament vote in the last week of June, includes stopping purchases under existing short-term contracts by June 17, 2026. An exception is made for landlocked countries importing Russian pipeline gas, which are «graciously» allowed to continue receiving it until the end of 2027. By the same deadline, all supplies under long-term agreements and purchases of liquefied natural gas (LNG) from Russia will cease.

Brussels is confident this stringent stance will be approved, as it now requires only a simple majority vote. No single member, including Hungary and Slovakia, which had repeatedly threatened to veto similar EU resolutions, will be able to block this directive.

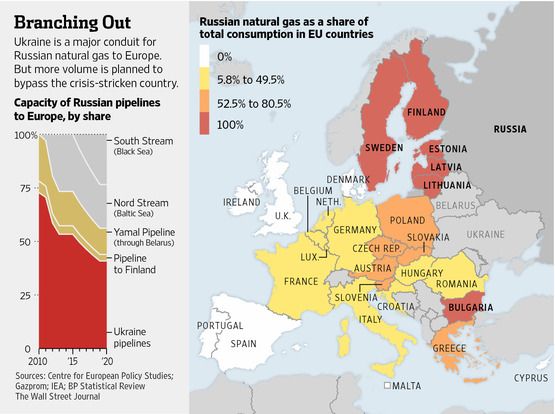

Implementing the moratorium will remove over 56 billion cubic meters of gas from the European market (20 billion LNG and 16 billion pipeline gas) currently supplied by Russia. This volume accounts for approximately 13% of total EU gas imports. However, the European Commission assures consumers that there is no need to fear an energy crisis. The shortfall is expected to be compensated by liquefied hydrocarbons from other global exporters and production from the planned Deep Neptun field in Romania. Additionally, Brussels urges residents of the Old Continent to conserve natural resources and increase the use of alternative energy sources.

Some EU states support the strategy proposed by European officials. According to Reuters, Spain, Belgium, the Netherlands, and France, which import Russian LNG, stated that if the sanctions include necessary legal justifications to avoid penalties and litigation with Gazprom, they will support the ban. Conversely, Hungary and Slovakia strongly oppose the imposed decision, calling the refusal to import Russian hydrocarbons a near-sabotage undermining the continent`s energy balance. Specifically, Hungarian Foreign Minister Péter Szijjártó declared that the roadmap prepared by the European Commission is a serious violation of European law and promised that Budapest will fight against the raw material blockade and continue energy cooperation with Moscow. Financial Times reported that Austria has called on its EU partners to reconsider the abandonment of Russian gas imports after the situation in Ukraine is resolved.

Hundreds of Billions at Stake

While the economic damage Brussels aims to inflict on Russia by ending gas purchases appears significant (EU paid around €5.4 billion for Russian gas in January-April this year, 17% more than in the same period of 2024), Europe`s own losses are considerably larger. According to Vladimir Putin, European nations have already lost approximately €200 billion due to reduced Russian gas imports. The EU risks similar losses in the future. Financial analyst Igor Rastorguev believes that «achieving a complete energy decoupling between Old World consumers and Russian energy suppliers will be extremely difficult, and possibly insurmountable, for both technical and economic reasons.» Replacing Russian supplies with hydrocarbons from other regions requires massive infrastructure development: building LNG terminals in Poland, Germany, and the Baltics, upgrading transport and transshipment hubs at seaports, and laying internal interconnectors between member states. The international research institute Bruegel estimates that continental countries will have to spend over €100 billion on these goals between 2023 and 2027 alone.

Experts believe that the «other producing regions» Brussels intends to turn to for replacing Russian supplies do not appear to be stable and reliable energy suppliers. According to Natalia Milchakova, a leading analyst at Freedom Finance Global, Germany, one of the largest gas consumers in the EU, might have to invest in building auxiliary pipelines from Norway. However, Norway is unlikely to supply an additional 20 billion cubic meters as its fields are nearing depletion. By 2030 or even earlier, the Scandinavian kingdom risks repeating the fate of the Netherlands, which went from being Europe`s second-largest gas exporter after the USSR to a net importer after its own reserves were exhausted.

Relying on Romania is also questionable. According to some European experts` forecasts, the Deep Neptun field will produce a maximum of only 8 billion cubic meters after 2027. After meeting domestic demand, the country will be able to export only 3-5 billion cubic meters, which is nowhere near the lost Russian volumes. «It`s not impossible that the EU will start centralized gas purchases from the US, as well as from suppliers in Africa and the Middle East,» suggests Milchakova. «However, for instance, Qatar only agrees to export LNG via long-term contracts, which EU members are reluctant to enter into, fearing new dependency on a single supplier.»

Unfavorable price conditions could also negatively impact EU consumers. If gas exchange prices in Asia are higher than in Europe, US exporters could easily divert supplies eastward, neglecting the Old World market. To secure transatlantic supplies, Europeans would have to offer Americans a higher price, whereas Russian pipeline gas imports always involved a fixed price defined in a long-term contract. «The cost of US LNG, including delivery and regasification, can be 30-50% higher than Russian pipeline supplies,» explains Rastorguev.

The situation with renewable energy sources (RES), which Europeans are encouraged to use to reduce natural gas consumption, also seems quite questionable. RES, in practice, do not always prove cost-effective or reliable. «To truly lower the cost of electricity generated from wind, solar panels, heat pumps, and building energy efficiency technologies, two important criteria must be met,» explains Natalia Milchakova. «First, favorable natural and climatic conditions are needed to enable large-scale electricity production. Second, the cost of electricity generation, including equipment costs, must be significantly lower than current price levels.» Today, a significant portion of equipment for solar and wind farms is manufactured in China, which has become much more cautious about replacing traditional fuel sources and is unlikely to significantly increase production of such devices, consequently being unlikely to reduce their sale price.

«Through RES, the EU aims to reduce hydrocarbon consumption by approximately 15-20% by 2027-2028,» notes Rastorguev. «This task is theoretically achievable, but it`s important to understand that industrial demand for traditional sources in countries like Germany, Austria, and Italy will not disappear entirely. In other words, gas will still be needed as a backup and regulating power source. In fact, Europe isn`t getting rid of hydrocarbons but is trying to reduce dependence. The actual figures for consumption reduction are constrained by costs and modernization timelines – requiring at least another €200 billion in investment by 2030.»

Overall, experts tend to believe that declarations of a complete refusal of Russian gas by 2027 and the plans being developed to replace «blue fuel» from Russia serve as a cover for increasing political pressure on Moscow. It is quite possible that after the currently displayed «loud» measures to ban Russian energy resources, Europe will continue to «quietly» import gas from Russia by repurchasing raw materials from intermediaries – China, as well as CIS or EAEU states (significantly overpaying third parties in the process).

«Amidst the upcoming European Parliament vote on introducing an anti-Russian moratorium, gas prices on the Dutch TTF exchange have already risen by 2%, closely approaching the $470 per thousand cubic meters mark. It can be expected that in 2027 and subsequent years, the final cost of `blue fuel` for European consumers will be $2000 or more,» forecasts Milchakova.

Authors: Roman Nikolaev