Gold prices have surged by 50% since the beginning of 2025.

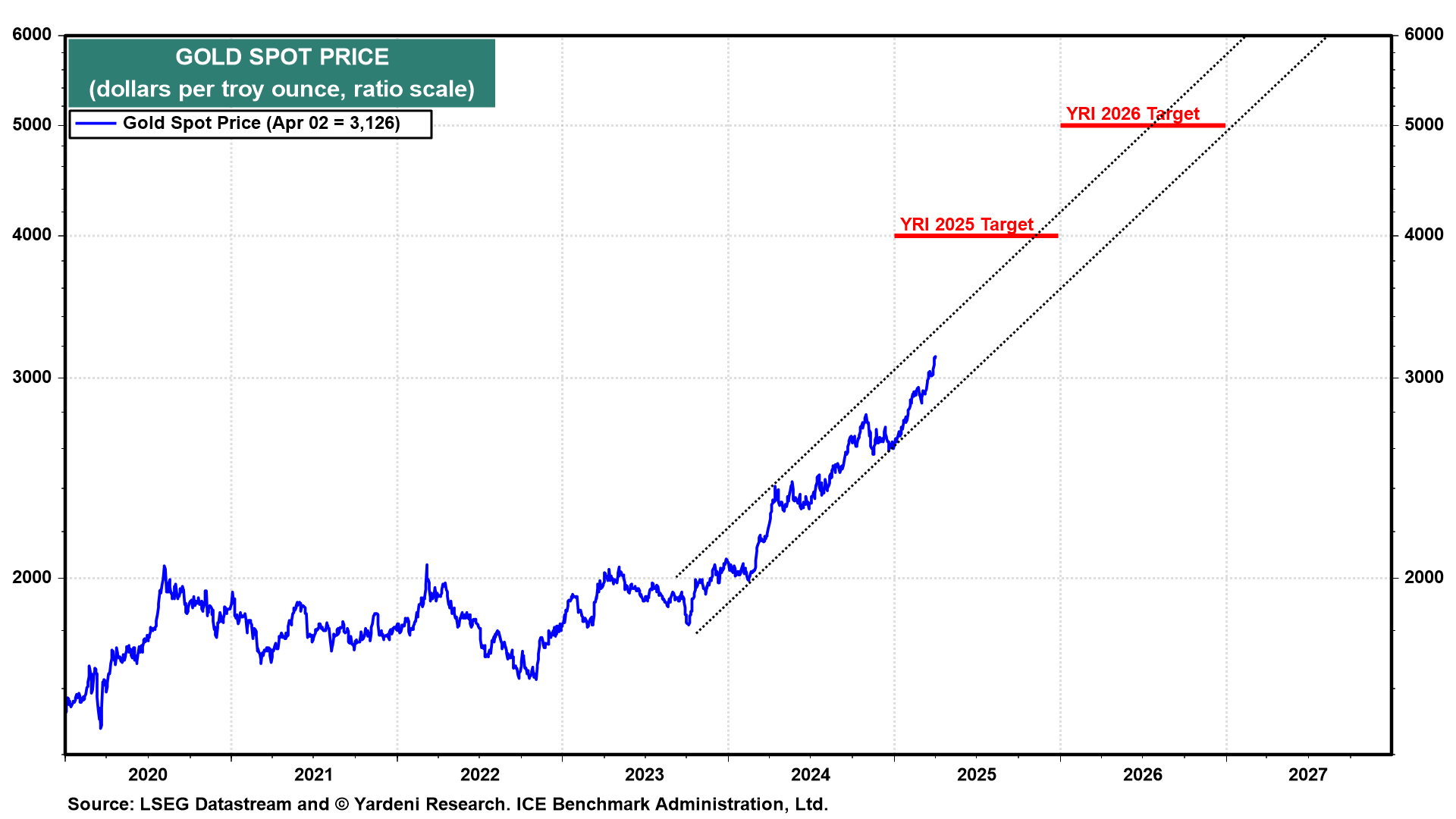

Over the past three and a half years, gold price dynamics have shown impressive growth. In mid-2022, an ounce was valued at approximately $1700, by 2023 its cost reached $2075, and a year later, quotes climbed to $2800. However, 2025 proved to be truly exceptional: in just ten months, gold made a rapid ascent, hitting an all-time high of $4000 per ounce on October 7.

Experts attribute the current surge in gold prices to a complex interplay of fundamental and short-term factors. The immediate catalyst for breaching the $4000 mark was the US government shutdown, which began on October 1, 2025. This budget crisis and political deadlock in Congress paralyzed a significant portion of the government apparatus for the first time in seven years.

Furthermore, political crises in France, where Sébastien Lecornu resigned after just 27 days as prime minister due to budget disputes, and in Japan, where Prime Minister Shigeru Ishiba also stepped down, further exacerbated investor concerns regarding financial stability in developed economies.

The Russian «Golden Revolution»

While global markets observed new gold records, a quiet financial revolution was unfolding in Russia. The abolition of VAT on the purchase of gold bars for individuals in March 2022 fundamentally transformed the investment landscape for ordinary Russians.

, head of client support and sales at «Alfa-Forex,» emphasized: «The abolition of VAT on investment gold has been one of the most successful decisions of recent years. It not only legalized the domestic market for physical precious metals but also transformed gold from a niche asset for the wealthy into a mass savings instrument.»

Over the past five years, Russian demand for physical gold has consistently increased. From 34.8 tons in 2020, it grew to 46.8 tons in 2021, reached 60.7 tons in 2022, and hit 71.2 tons in 2023. Notably, in 90% of cases, citizens prefer purchasing gold bars. Furthermore, the volume of gold trading on the Moscow Exchange in 2024 reached an impressive 123.3 tons, a 47.3% increase compared to the previous year.

«By this metric, we are currently surpassed only by China, India, the USA, and Turkey,» concludes . «This indicates that gold has truly become a `people`s asset,` primarily serving as a tool for preserving savings rather than for short-term speculation.»

, Managing Partner at B&C Agency, confirmed the effectiveness of this decision: «The abolition of VAT has fully justified expectations. Amid current economic uncertainty and inflation, purchasing gold has become an attractive alternative to foreign currency for Russians. The significant volumes of precious metal purchases confirm its status as a truly national asset.»

Impact on Jewelry Prices

According to experts, for investors who bought gold several years ago, the current situation presents an excellent opportunity to realize substantial profits. Nevertheless, newcomers considering a purchase are advised to proceed with caution.

notes: «The ruble cost of gold jewelry has already increased significantly. Further price hikes for jewelry are expected, as their valuation is influenced not only by global gold prices but also by the ongoing weakening of the ruble.»

, a stock market expert at «BCS World of Investments,» provided specific data: «From January to September, price increases ranged from 14-15% for gold rings and pendants to 17-18% for chains and bracelets.» He added that retailers are exercising restraint in raising prices, fearing a drop in already sensitive demand.

Financial analyst highlights an important nuance: «The exchange price of gold and its retail cost are not the same. Jewelry uses alloys, not pure metal. The current rise in exchange prices will not immediately translate into higher store prices, as retailers are selling previously purchased inventory. In the short term, prices might increase slightly by 5-7%, but over several months, the growth will become more pronounced.»

What`s Next for Gold Investors?

The main question occupying both experienced and novice investors in precious metals is what steps to take next. There is no consensus among analysts. Proponents of a conservative approach believe that a correction is inevitable after such a rapid ascent.

warns: «It`s already too late to invest in gold and other precious metals for investment purposes – there`s a risk of being caught in a correction. The asset has significantly appreciated over the past few years and appears clearly overheated in the medium term.»

shares this viewpoint: «Current price levels make new purchases less attractive. After such rapid growth, there`s a high probability of a correction, potentially to the $3650-$3700 per ounce range in the coming weeks. From an investor`s perspective, it`s wiser now to partially secure profits rather than increase positions.»

Optimistic experts recommend focusing on the long-term perspective and utilizing any price dips for new purchases. «Gold prices traditionally rise during times of instability, and the global economy is still far from stable. Gold will retain its value, even if the dollar and euro significantly weaken,» states .