Experts believe this could be a significant blow to Russia.

Western media extensively covered the statement by Indian Oil Minister Hardeep Singh Puri, indicating Delhi`s readiness to cease Russian energy imports due to the risk of Washington imposing 100% tariffs on exports to the US. The Economist suggests that the Trump administration might refrain from such drastic measures to avoid destabilizing the global market and causing unpredictable oil price surges. In contrast, CNN anticipates that the US could indeed follow through with its threat, compelling India and China to halt Russian raw material purchases to steer clear of complications.

At an industry forum in New York, Hardeep Singh Puri stated, «I am not worried at all. If something happens, we will deal with it.» The minister emphasized that India has actively diversified its energy sources and is collaborating with approximately 40 suppliers, including Brazil, Canada, and Guyana, who can offset any potential supply shortfalls.

Earlier, Donald Trump announced intentions to impose secondary tariffs of approximately 100% on buyers of Russian raw materials if no progress is made in resolving the conflict in Ukraine within 50 days, with a deadline of September 3. NATO Secretary General Mark Rutte, in turn, urged India, China, and Brazil to cease trade with Moscow, warning of severe repercussions from potential US sanctions. «You should consider this, as it could hit you very hard,» Rutte cautioned.

According to Reuters, in the first half of 2025, Russia remained India`s largest oil supplier, surpassing Iraq, Saudi Arabia, the UAE, and the US, accounting for 35% of India`s total imports. The primary reason for these significant purchases is economic advantage: discounts on Russian oil, driven by Western sanctions, reach $15-20 per barrel. India currently imports approximately 1.8 million barrels of Russian oil per day (1% more than the previous year), primarily the Urals grade, transported mostly by sea. China, meanwhile, buys about 2 million barrels per day, preferring the more premium Russian ESPO grade, delivered via pipelines. This year, Turkey emerged as the third-largest client, purchasing 400,000 barrels per day from Russia.

Fundamentally, there are no other global markets for Russian oil comparable in scale to India and China. It is also clear that both nations, in their trade with Moscow, are guided solely by their own economic benefit and national interests, rather than political solidarity or charity. Consequently, should the US impose 100% tariffs, it is highly probable that their decision will not favor Russia. The United States is a crucial and vital trade partner for both India`s and China`s economies, with their exports to the US significantly outweighing their imports of American goods.

Expert Opinions on India`s Potential Shift

To understand the potential implications for Russia and India should Washington implement the announced tariffs, we consulted experts.

Question: Can India effortlessly and without significant detriment replace Russian oil with supplies from other countries?

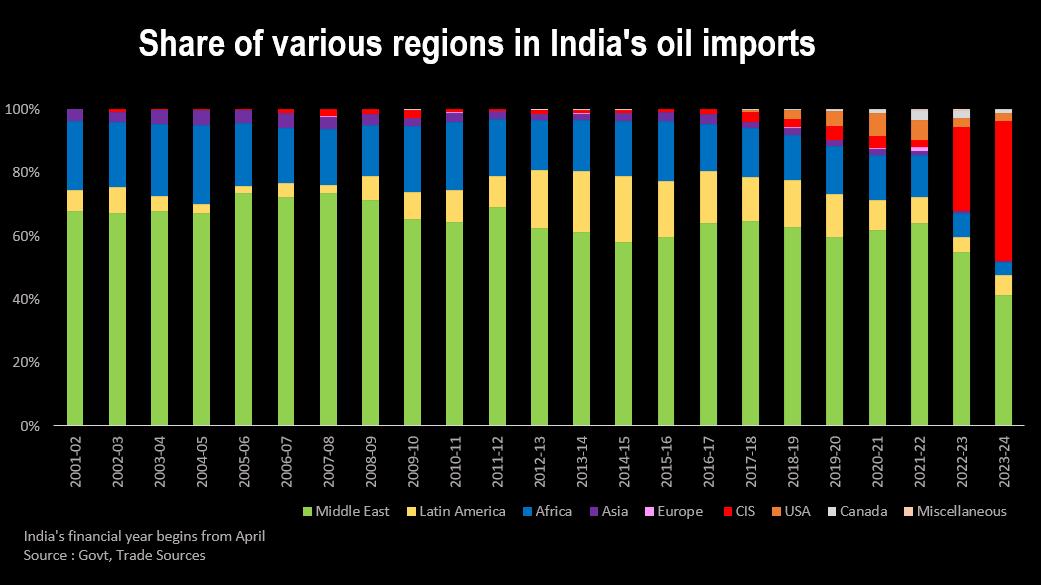

In the first half of 2025, India imported over 318 million barrels of oil, totaling approximately $22 billion at an average export price of $69 per barrel. The surge in Indian imports is attributed to both geopolitical factors and favorable pricing, as Russian oil continues to be sold at a substantial discount to Brent. However, the prospect of sanction tariffs threatens the stability of these supplies. Should Trump`s declarations materialize, India may re-evaluate the share of Russian oil in its energy portfolio, increasing purchases from alternative suppliers, including countries in the Middle East, the US, and Brazil.

It will be extremely challenging for India to fully and promptly replace Russian oil with supplies from other sources. This process would necessitate a significant overhaul of the entire procurement system, from negotiating new contracts to reconfiguring logistical routes. It is questionable whether India truly desires or possesses the capacity to undertake this. Theoretically, Delhi could increase purchases from its traditional partners—Saudi Arabia, Iraq, the UAE, or the US—but this would be considerably more expensive. Furthermore, expanding supplies might face limitations due to both technical and political factors. An important nuance is that not all crude oil grades are suitable for Indian refineries.

In my opinion, the statement by the Indian Oil Minister is primarily a political gesture aimed at the US and Western media. India`s actual energy supply structure, logistics, and economic priorities suggest otherwise. Over the past two years, Russia has become India`s primary supplier, displacing Saudi Arabia and Iraq from that position. Russian oil is offered with significant discounts, flexible payment terms, and often with included logistics. This business is built on pragmatic interests, not emotions: Indian refineries are adapted to the Urals grade, and stable supply channels have been established, which are unlikely to be severed painlessly. If the US genuinely imposes secondary sanctions on buyers of Russian oil, India will most likely continue purchasing from Moscow, albeit possibly through more complex and circuitous schemes.

Question: Can Moscow compensate for lost oil export volumes if India genuinely ceases purchasing Russian raw materials, fearing Washington`s secondary sanctions?

For Russia, this would diminish export revenues and pose risks to budget inflows. Nevertheless, if discounts persist and logistics remain flexible, Russia could maintain its position in the Indian market, especially if Indian refineries are willing to share sanction-related costs. Thus, despite political pressure, Moscow is unlikely to completely lose India as a buyer in 2025. However, adjustments to supply volumes and payment terms are highly probable. In the short term, exports to India will likely remain at 1.7-1.8 million barrels per day, but annual revenue could drop from last year`s $40 billion to $30-32 billion.

India`s potential refusal to purchase could be a tangible blow to Russia. The Indian market became one of the most crucial after trade with Europe declined. It would be extremely difficult to quickly find a buyer of comparable scale. China already imports significant volumes (2 million barrels per day), and Southeast Asian markets cannot instantly absorb tens of millions of additional tons. In the short term, this would likely intensify price pressure on Russian oil and lead to increased logistics costs.

I believe that India will continue to acquire oil from Moscow regardless, possibly through more intricate schemes. Therefore, Russia will not need to actively seek new markets. Mechanisms such as parallel imports, flag changes for vessels, and insurance through friendly jurisdictions are already well-established. There is every reason to assume that unspoken agreements already exist between Moscow and Delhi on how to maintain supplies under Western pressure, without directly violating formal restrictions.