Professor Zubets: «The need for it has essentially disappeared»

The mechanism of parallel import, initially considered an anti-sanction measure and a lifeline for the Russian consumer market, is now clearly diminishing in importance for the state. In May, the value of goods imported via this channel totaled $2.3 billion – more than three times less than during the peak in 2022. Officials at the Ministry of Industry and Trade attribute this trend to two main factors: the expansion of domestic production and the successful establishment of legitimate supply routes.

The Ministry of Industry and Trade not only observes a consistent decline in the volume of goods imported through parallel import (PI) but actively supports it, stated Deputy Head of the Ministry Roman Chekushev. He added, «We will be transitioning towards standard legal relationships with foreign rights holders.» Earlier, Minister Anton Alikhanov explained that the demand for imported goods in Russia is decreasing (especially in sectors like clothing, footwear, and electronics) as local products and brands gain traction and are «recognized» by the public. Moreover, «the structure of supplies is shifting; more alternative products are being sourced from friendly nations.»

According to Alikhanov, the government intends to make «targeted» adjustments to the list of goods permitted for PI in 2026. The list will be «definitely» shortened, though this will be done carefully to prevent shortages of any specific items. The most recent review occurred in April this year, resulting in the exclusion of laptops from certain brands, laser printers, and some types of cosmetics. The Ministry of Industry and Trade reports that Russia currently boasts over 800 domestic cosmetic and perfume manufacturers.

The PI mechanism, which permits importing goods into the country without the manufacturer`s or rights holder`s consent, has been active since spring 2022. The initial list was largely composed of vehicles from Western brands that had left the market, along with their spare parts, consumer electronics, mobile phones, musical instruments, cameras, furniture, and linens. A significant limitation was the lack of diversification; PI primarily served the consumer sector, offering minimal benefit to domestic industry. Experts pointed out that importing industrial equipment and technology through «parallel» channels was considerably more challenging. Key drawbacks for the average consumer included the absence of standard post-sales service from manufacturers, difficulty securing warranties, repairs, and replacements for purchased items. Prices were also typically 10-20% higher than for direct imports, primarily due to increased logistics costs.

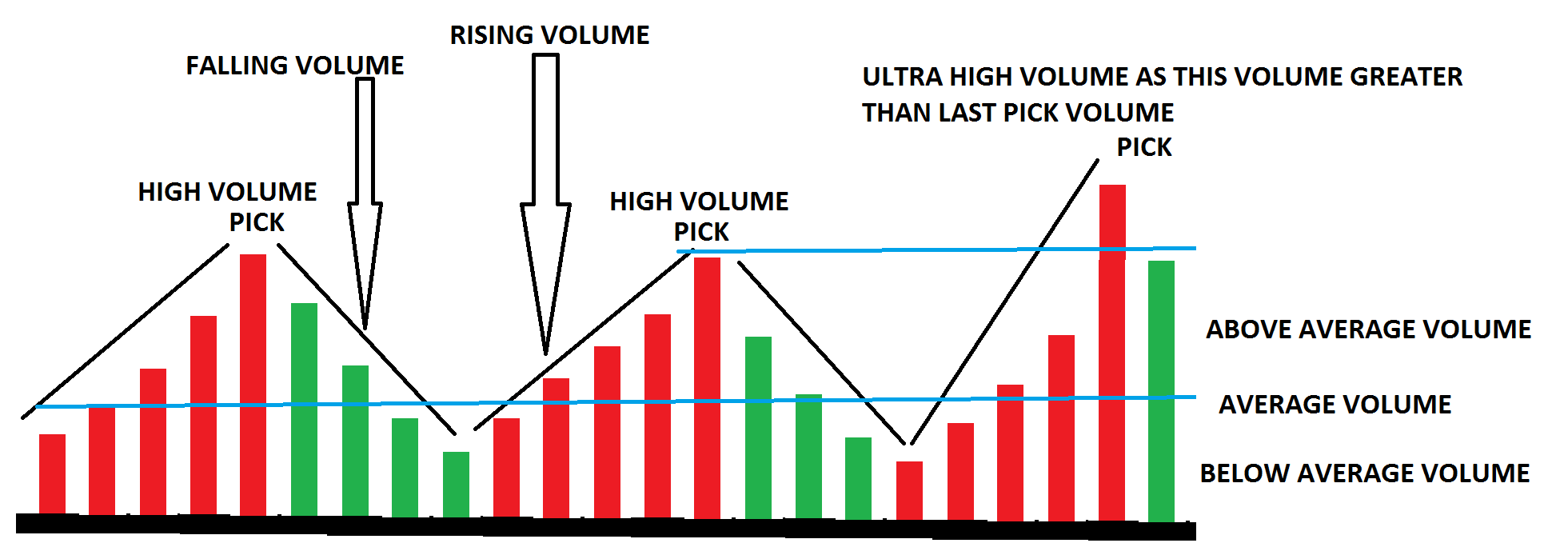

The declining trend in average monthly PI volumes over the past four years is evident: they stood at $7.5 billion in 2022, $6.2 billion in 2023, $4.8 billion in 2024, and currently $2.5 billion. By comparison, in April this year, total imported goods into Russia amounted to $22.6 billion. The volume of cars imported under the PI scheme plummeted by 74% year-on-year in January-May, totaling 19 thousand units. Overall, 311.8 thousand cars have entered the Russian Federation through countries of the former USSR (primarily Kyrgyzstan and Kazakhstan) over 3.5 years.

«The need for parallel import has essentially disappeared, as we have successfully established legal supplies for nearly the entire range of required goods,» argues Alexey Zubets, Director of the Center for Social Economy Research. «For example, truck parts that were previously brought in `through unofficial channels` from Europe are now officially procured from China. These supplies involve the payment of all taxes and are overseen partly by the state and partly by major corporations.»

Regarding the challenges of foreign trade settlements, this issue is also largely resolved today through a form of de facto barter. Zubets explains that when Russian oil is sent to China, the currency paid for it remains within China; there are no cross-border transfers and, consequently, no risk of secondary sanctions related to them. Importers then use these funds to purchase all necessary goods in China, which are subsequently shipped to the Russian Federation.

«On one hand, the May figure of $2.3 billion signals a reduction in parallel import volumes, but on the other hand, it points to significant shifts,» says Artur Leer, Vice President of the Association of Exporters and Importers (AEI). «Firstly, domestic production has made strides, particularly noticeable in the fast-moving consumer goods (FMCG) sector. Niches previously filled by goods imported through the parallel import mechanism are now being confidently developed by entrepreneurs within the Russian Federation. Secondly, where complex PI schemes were previously necessary, direct or more straightforward import channels have now been established – offering the same functionality and quality but without the risks associated with sanctions.»

According to Leer, the decrease in PI volumes doesn`t indicate a shortage but rather a redistribution: some products are now simply arriving via different logistical routes. As for payment issues, Russian businesses have today developed stable and effective schemes.