What to prepare for if you`re going on vacation, to the market, or to the store.

Economists and analysts are factoring in a moderate weakening of the ruble for July 2025 in their baseline scenarios, predicting no sharp movements. The range of forecasts spans from 77 to 85 rubles per dollar. However, some individual assessments suggest the possibility of strengthening the ruble to 70 rubles per dollar or weakening it to 89. Key influencing factors include the conclusion of the tax period, the policy of the Bank of Russia, the dynamics of export revenues, as well as geopolitical risks and conditions in commodity markets.

According to financial analysts, the ruble`s exchange rate in July 2025 will be shaped by a combination of factors. While none of these factors alone is expected to fundamentally change the trajectory, their interaction could lead to short-term fluctuations. Among the main variables are the tax calendar, the Central Bank`s actions, the balance of exports and imports, and the geopolitical agenda. Analysts provide a wide spectrum of forecasts, from 70 to 89 rubles per dollar, but the core estimates are clustered within the 80–85 range.

Alexander Bakhtin, investment strategist at Garda Capital, believes that changes in the export-import balance, commodity price dynamics, and signals from the Bank of Russia will have the most significant impact on the rate in July. «Furthermore, the demand for currency from outbound tourists might become more pronounced in July,» the expert adds.

He states that a rate of 70 rubles per dollar is only conceivable with a substantial easing of geopolitical tensions, for instance, if political agreements are reached and sanctions begin to be lifted. The analyst considers a scenario near 89 rubles per dollar overly pessimistic: «This would require a sharp contraction in export inflows coupled with a rapid increase in imports. There are no preconditions for either.»

Igor Rastorguev, lead analyst at AMarkets, warns that the end of the tax period could be an additional factor in July. This means a reduction in the volume of foreign currency earnings repatriated by exporters for tax payments. «If the supply of currency from commodity companies decreases, pressure on the ruble will intensify,» the expert notes. However, stable oil prices could partially compensate for this effect.

Rastorguev also mentions that the ruble`s rate is sensitive to global market conditions. High demand for the dollar as a safe haven asset may continue to exert pressure, especially amidst the unstable situation in Europe and persistent geopolitical uncertainty.

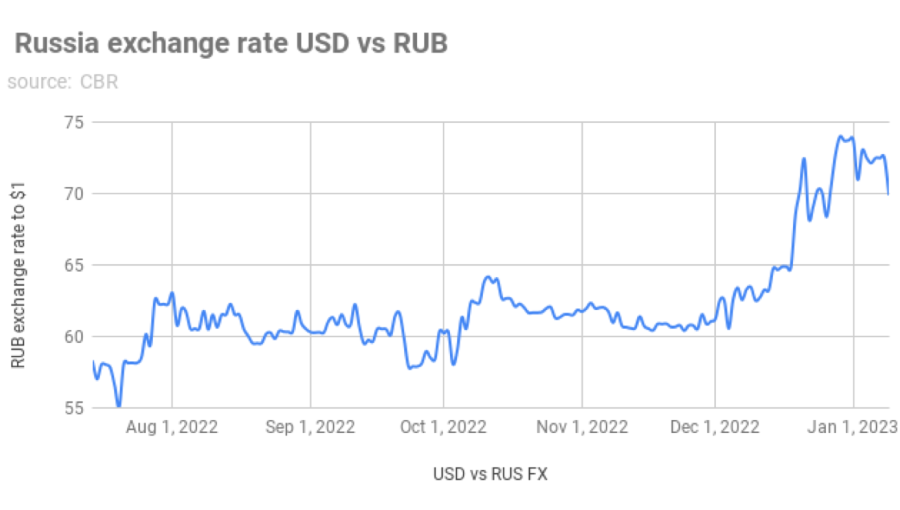

According to Spartak Sobolev, head of investment strategy research at Alfa-Forex, the ruble is concluding the first half of the year with a strengthening of over 20% against the dollar. The main supporting factors are the Central Bank`s stringent policy, stable oil prices, and reduced sanctions pressure. «In July, the Bank of Russia may continue monetary policy easing within 1%, which will act as a factor in slowing the ruble`s upward trend within the 77–82.50 rubles per dollar range,» he comments.

The impact of exchange rate fluctuations on the consumer market is anticipated to be moderate, according to Bakhtin. A sustained ruble depreciation of 10% could slightly increase annual inflation. This primarily affects categories with a high foreign currency component, such as household appliances, electronics, pharmaceuticals, alcohol, and tourism services.

Most experts currently deem a sharp devaluation scenario unlikely. As analysts emphasize, the Central Bank`s focus is not on maintaining a specific rate but on smoothing out abrupt swings. They still have tools at their disposal like currency interventions, regulation of export revenue repatriation requirements, and monetary instruments. However, these measures will likely be applied selectively and reactively in case of short-term imbalances.

For private investors and consumers, experts suggest July is a suitable time for planned diversification. «If you need foreign currency for a trip abroad or to build the currency portion of your portfolio, the current moment can be considered favorable. However, for systematic savings, it is better to buy currency in small increments,» advises Bakhtin. This helps to mitigate the impact of short-term volatility and avoid investing at an unfavorable rate.

Overall, market participants expect July to feature moderate exchange rate dynamics. The 80 rubles per dollar level serves as a reference point for most forecasts. The primary risks remain external: increased sanctions pressure, lower commodity prices, and unpredictable reactions from global markets. For now, the ruble maintains its position within the expected range, showing relative stability amidst limited money supply and weak imports.