Analyzing the Rising Debt Burden Among Russian Borrowers

Regardless of its formal definition, personal bankruptcy represents a profound mental and existential experience for an individual, rather than merely a legal formality. It leaves an indelible mark not only on one`s credit history but also on their psyche. The adage «this too shall pass» often doesn`t apply here. Impersonal statistics capture only the tip of this socio-economic iceberg, failing to reflect its true depth and impact.

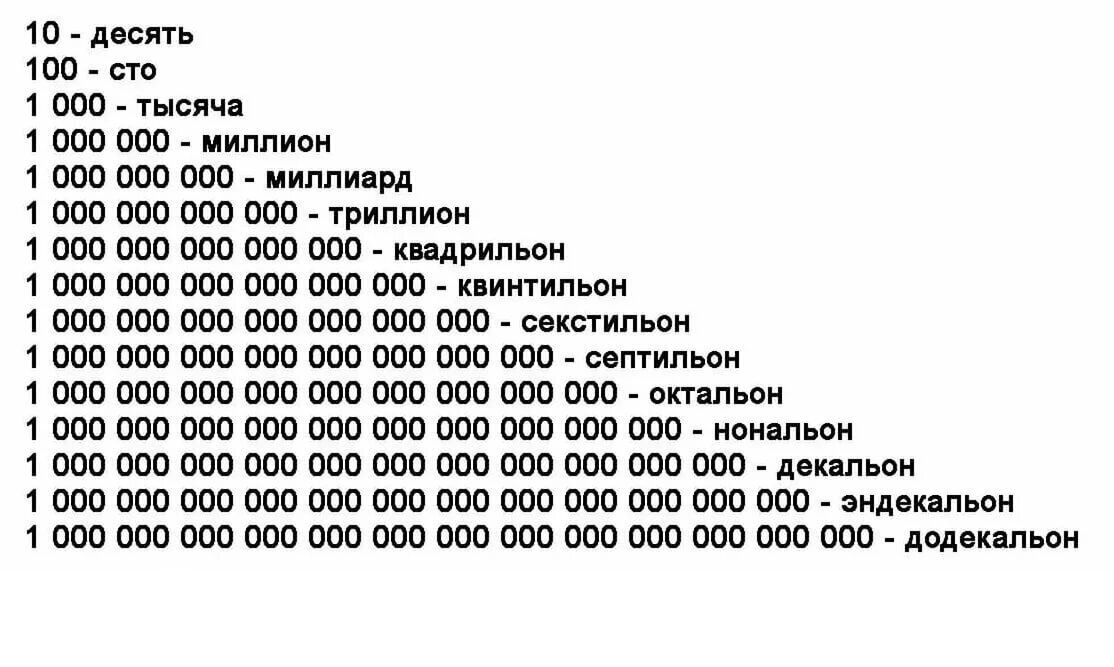

Let`s turn to the statistics. According to Fedresurs, last year, courts declared 431.9 thousand citizens bankrupt, a 23.5% increase from 2023 (349.6 thousand). Additionally, 55.6 thousand people utilized the simplified out-of-court bankruptcy procedure via the MFC (Multifunctional Centers), a staggering 250% increase year-over-year. Since the bankruptcy mechanism was introduced in Russia in 2015, the total debt owed by individuals who have received this status has reached approximately 4 trillion rubles.

This year, personal bankruptcy proceedings are accelerating at an unprecedented rate. According to a major state bank, during the first two quarters of 2025, six bankruptcy procedures were initiated every minute in Russia – a striking pace. Yet, behind these figures lies something more significant: the underlying factors fueling this phenomenon are also reflected in various statistics. For instance, according to the Central Bank, the share of non-performing loans (overdue by more than 90 days) in Russian banks` consumer loan portfolios currently stands at 10.5%, a 2.8% increase from 7.7% a year ago. Furthermore, a NAFI survey last year revealed that 73% of citizens lack sufficient savings to live without a regular income (salary or deposit interest) for even a single quarter.

The overall picture, therefore, is composed of numerous fragments. This includes data from a KonfOP survey, where 22% of respondents are unable to pay interest on their loans, 18.5% allocate more than half of their monthly income to debt repayments, and 21% consider their debt burden unbearable. All these categories of citizens are, in essence, potential bankrupts — not just legally, but also based on their subjective feelings, which is equally significant. A borrower doesn`t necessarily need to wait for a 90-day delinquency or file for personal bankruptcy to realize the futility of their situation; this understanding can emerge within a few days after a missed payment, or even instantaneously.

Bankruptcy is an extreme and forced measure, resorted to only after all attempts at debt restructuring or negotiations with creditors have proven unsuccessful. Currently, the total debt of Russians to banks stands at 35 trillion rubles. On average, each economically active citizen bears a debt load of 459 thousand rubles, with 50 million people having at least one loan. However, where is the invisible line that separates these individuals from bankruptcy, not necessarily legally formalized? This boundary is elusive and treacherous, much like quicksand in a desert, which lies in wait for travelers at almost every step and inevitably swallows those who treat the element with disdain.

A typical scenario involves individuals taking new loans to cover old ones. Due to haste or lack of awareness, they fail to scrutinize interest rates and penalties for overdue payments. This illusion of easy solutions and impunity creates a snowball effect, deepening the debt spiral: for instance, after borrowing 300,000 from a bank and failing to repay, an individual turns to microloans, which also go unpaid on time. Consequently, the total debt swells to 1.8 million rubles, followed by fines, legal proceedings, and forced collection. Obtaining the «savior» status of a bankrupt in this situation is no longer the primary concern. It`s crucial to remember that a declared bankrupt faces limitations: they are prohibited from taking new loans, acting as a guarantor, engaging in certain transactions, or conducting business through a legal entity. The core issue lies in long-term trends that offer no promise of financial well-being to the populace.

Over time, debt obligations are increasingly weighing on the financial capabilities of Russians. A growing number of citizens face situations where «debits and credits don`t align,» driven by inflation, stagnant real incomes, relentlessly rising utility tariffs, and many other factors. Repaying loans today is significantly harder than three or four years ago: the average interest rate on credit cards is 40% annually, on microloans it`s around 290% (or 0.8% per day), and on car loans, it`s 25-27%. These are the invisible parts of the «iceberg» that, while not directly present in personal bankruptcy statistics, form its foundation. According to Fedresurs estimates, by 2029, the number of citizens declared financially insolvent will no longer be in the hundreds of thousands but could reach 1.8 million people. This represents an entire army of debtors ready to «surrender» to financial difficulties.