Production of alcoholic beverages in Russia has plummeted significantly due to steep increases in excise taxes and minimum retail prices.

Photo Credit: Alexey Merinov

In the first half of 2025, the production of alcoholic beverages in Russia decreased by 16.1%, totaling 73.89 million decaliters. This represents a substantial drop. While multiple factors contribute to this decline, a key reason is the sharp increase in excise tax rates and minimum retail prices.

According to Rosalkogoltabakkontrol (RATK) data, the output of spirits with an alcohol content exceeding 9% fell by 9.5% from January to June, reaching 46.82 million decaliters. Within this category, vodka production declined by 10.9% (to 31.38 million decaliters), and liqueur and vodka products by 0.5% (to 8.04 million). The most dramatic decreases were seen in low-alcohol beverages like gin and tonic, which plunged by 91.6% (to 725.4 thousand decaliters), and cognac, down by 17% (to 3.45 million).

Wines remain the only category showing growth, with still and sparkling wine production increasing by 12.4% (to 17.6 million decaliters) and 18.5% (to 7.2 million) respectively in the first half of the year. Conversely, fortified wine production dropped by 9.6% (to 644.9 thousand decaliters, primarily due to the higher excise tax on the spirit used in their making.

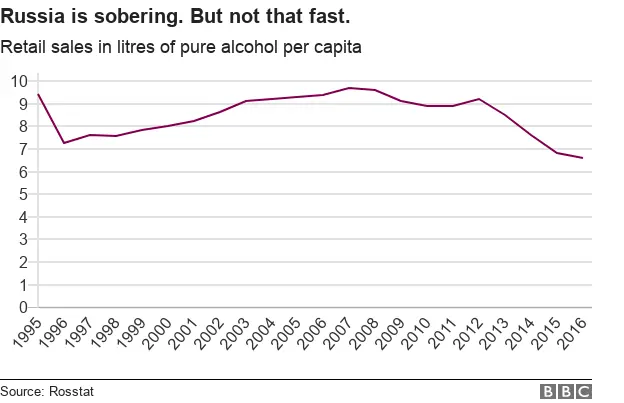

«RATK attributes the situation to the 15% increase in excise rates and the almost 17% hike in minimum retail prices (MRPs) for vodka and cognac effective January 1,» states Pavel Shapkin, head of the Center for National Alcohol Policy Development. He describes the associated costs as «completely insane.» Winemakers are granted some relief, with producers of still and sparkling wines receiving tax deductions on excise taxes if they use domestically grown grapes. Shapkin adds that production is also decreasing because younger generations (Generation Z) are consuming fewer alcoholic beverages, particularly strong ones. This global trend is influenced by a desire for healthier lifestyles as well as economic constraints and lack of disposable income.

Given the planned increases in excise tax rates over the next two years, market conditions are expected to push consumers towards significantly cheaper alternatives. This could include practices like home distilling, making homemade wine from grapes, or brewing beer. For example, a kilogram of barley, costing around 20 rubles, can yield 10 liters of beer. However, these methods require time, skill, and considerable patience.

The primary advantage of homemade alcohol is the extremely low cost compared to store-bought options. The main drawback is inconvenience. While having homemade stock ready is one thing, the ease of simply going to a corner store to buy and consume factory-made drinks gives them a considerable edge over home production. Pavel Shapkin highlights that the minimum retail prices for vodka and liqueur and vodka products rose by 50 rubles per half-liter since January 1. This substantial price increase mainly impacted the economy segment and is inevitably affecting overall production volumes.

Ruslan Bragin, an expert in strong alcohol marketing and a member of the Guild of Marketers, notes that the Russian government has approved a concept to reduce alcohol consumption until 2030, and RATK aligns its activities with this goal. The agency is tasked with taking specific actions and reporting on them. Furthermore, Bragin observes a genuine trend towards healthy living in the country. He suggests that the 16% production decrease from January to June might also be linked to overproduction by liqueur and vodka plants and warehouses being overstocked before the New Year, requiring them to sell existing inventory. Each company operates with its own marketing plan and agreements with hospitality and retail sectors.

Bragin also points out that sanctions have reduced export volumes to unfriendly countries, and in 2024, import restrictions, including inflated duties, were introduced. From a consumer standpoint, many Russians are cutting back on alcohol due to reduced purchasing power. High inflation means people can no longer easily afford items they previously could, prioritizing essential products like meat, potatoes, bread, and milk over alcohol.

Petr Shelishch, co-chairman of the Union of Consumers of the Russian Federation, views the decline in spirit production as an indicator that Russians are shifting from a «northern» alcohol consumption model (prioritizing strong drinks) to a «southern» model (favoring wines, beer, and weaker beverages). He believes this is a positive development. Shelishch argues that the southern model leads to fewer deaths from accidental alcohol poisoning and related illnesses compared to the northern model. Regarding the tenfold decrease in low-alcohol product production (which he describes as essentially spirit diluted with sweet soda), he notes that serious restrictions were placed on their sales. He considers this a good sign, as these drinks facilitate alcohol consumption among teenagers by creating a habit based on appealing flavors.