Experts explain bank behavior and provide forecasts.

This autumn, Russian banks have significantly increased the frequency of reducing credit card limits. This trend is evident from a surge in complaints on specialized platforms, forums, and in media reports. Industry experts attribute these banking actions to a desire to lower borrowers` overall debt burden and to avoid increasing reserves, as required by the Central Bank of Russia. This article explores which cardholders are most at risk of having their limits reset to zero and the reasons behind this.

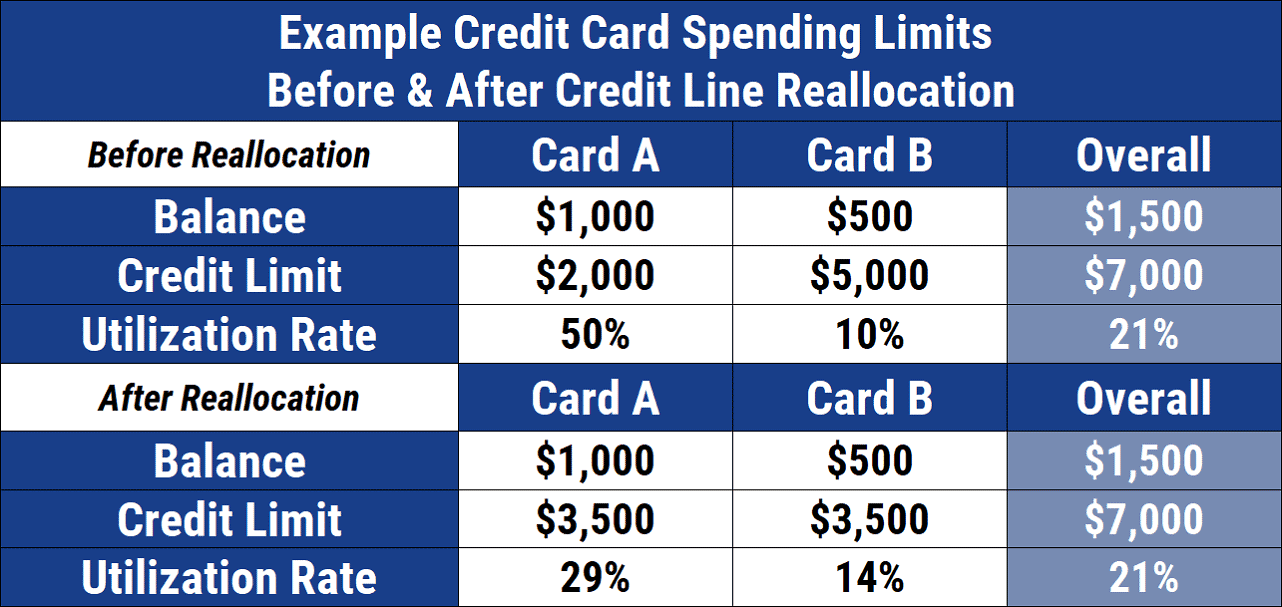

Banks in Russia are actively canceling or reducing credit limits for cardholders to decrease clients` «Maximum Debt Load» (MDL) ratio. This ratio should not exceed 80%; otherwise, banks face restrictions on issuing new loans. The MDL indicates what portion of an individual`s monthly income goes towards financial obligations versus what remains for other expenses.

Evgenia Lazareva, head of the «For Borrowers` Rights» project of the People`s Front, explains: «If a bank disregards regulatory recommendations and lends to a borrower with a high debt load, it must reserve 100% of the amount in case of default to ensure its obligations to depositors.» She provides an example: even if a client with a 100,000 ruble credit limit spends only 5-10 thousand a month and makes timely payments, the bank is still forced to factor the full 100,000 into the debt load calculation. Consequently, banks are reducing limits for over-indebted clients, worsening initially attractive terms, and also zeroing out limits for inactive card users. This is part of an optimization strategy, Lazareva added.

Investment advisor Yulia Kuznetsova points out that for many Russians, credit limits serve as a «financial safety net» for unforeseen expenses. A sudden zeroing out of a limit deprives them of this sense of stability, particularly affecting borrowers with unstable incomes and no savings. Kuznetsova forecasts that up to 20-30% of credit card holders may face limit reductions, primarily those who actively use borrowed funds and have a high MDL ratio. She emphasizes that this doesn`t imply a «bad» client history but rather a bank`s measure to mitigate potential losses and reduce the reserves that the Central Bank of Russia mandates for high-risk loans.

Tatyana Belyanchikova, Associate Professor at the Department of Global Financial Markets and FinTech at Plekhanov Russian University of Economics, clarifies that the zeroing out of credit limits is not a violation. «Banks have the right to adjust credit card limits, both upwards and downwards, which is typically stipulated in the credit agreement upon issuance,» she reminds. However, the widespread nature of such actions signals a concerning trend: banks are taking precautionary measures due to the deteriorating quality of their loan portfolios and the general economic slowdown.

Natalia Milchakova, a lead analyst at Freedom Finance Global, adds that banks currently find it unprofitable to maintain two extreme types of credit card borrowers in their portfolios: undisciplined clients who have long exceeded their interest-free grace period and repay the principal over years with minimal payments, and, conversely, overly disciplined clients who either don`t use their card at all or use it very rarely and only during the grace period for small purchases.

Yulia Kuznetsova warns that in such a situation, some citizens might turn to microfinance organizations (MFOs) for loans, where interest rates are significantly higher, potentially increasing indebtedness among the most vulnerable segments of the population. Natalia Milchakova adds: «If banks were to stop issuing credit cards entirely, borrowers would either have to approach MFOs, frequently borrow from relatives and friends, or learn to live within their means and build savings as a `financial safety net`.» Nevertheless, a widespread zeroing out of limits is unlikely, as credit cards remain a highly profitable product for banks.

Alexey Volkov, Marketing Director of the National Bureau of Credit Histories, states that when approving credit limits, banks will prioritize borrowers with an impeccable credit history and a low MDL, not exceeding 50%. Consequently, Russians who wish to maintain or obtain a substantial credit limit should diligently monitor their credit history and prevent its deterioration.