Key Risk Factors Identified: Central Bank Rate, Tax Burden, and Geopolitical Uncertainty

There is no longer any doubt that the Russian economy has slowed its growth rate. Official statistics from Rosstat clearly confirm this. For example, in the first quarter of 2025, GDP growth was 1.4%, compared to 4.3% for the entire year 2024. Compared to the previous quarter (the last quarter of 2024, which saw a 4.5% increase) or year-on-year (5.4% growth in Q1 2024), the slowdown in economic growth is already measurable in multiples. However, let`s not despair prematurely, as positive growth rates are still maintained for now. But this naturally raises the question: what`s next?

The recently concluded St. Petersburg International Economic Forum did not provide a clear answer. Even government ministers disagreed in their assessments. Various diagnoses were voiced: from high platforms, there were mentions of the Russian economy being on the verge of entering a recession, undergoing cooling, and, of course, the assertion that warming would follow the cooling period. So, where does the Russian economy find itself today: on the verge? beyond the verge? or somewhere else?

Let`s set aside the optimistic claim that warming will follow the cooling. Of course, it will happen eventually. But what should concern us today is the clear economic slowdown, while things improving «sometime in the future» is just that – in the future. This leaves us with the diagnoses: «cooling» and «on the verge of entering a recession.» These diagnoses aren`t mutually exclusive, by the way, because one can end up on the verge of a recession precisely as a result of cooling. So, the real question is: has our economy reached the verge of recession, or does it still have reserves and can afford to «cool» further, potentially leading to recession?

It`s an interesting question, no doubt… But there`s another equally interesting one: if we are on the verge of recession, is it inevitable? I`ll start with the second question. There were also interesting judgments on this matter at the St. Petersburg Economic Forum. Notably, the head of the Ministry of Economic Development, Maxim Reshetnikov, spoke about being «on the verge of entering a recession.»

I personally share Reshetnikov`s point of view. However, it should be noted that the minister emphasized that being «on the verge of entering a recession» doesn`t mean we are already in one or necessarily will be. While that`s true, here`s the problem: the economy is a huge, complex, and heavy entity (especially the Russian one). Its inertia is a key characteristic. Like a freight train, it cannot stop instantly, let alone reverse direction. Therefore, if cooling leads the economy to the verge of a recession, it will almost certainly enter that recession – due to inertia, so to speak.

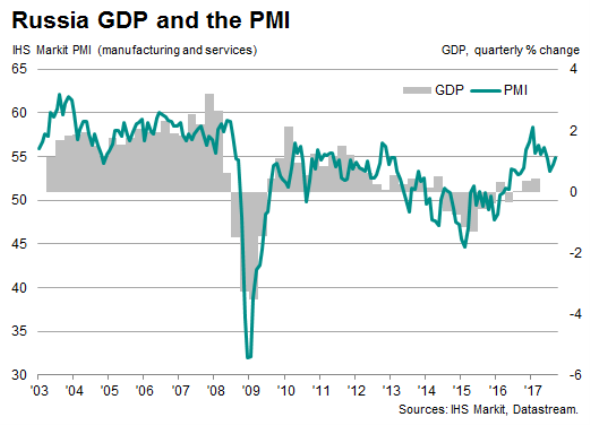

Skeptics will naturally say: what kind of analysis is this: economic heaviness, inertia?… Where are the figures showing that the economy is truly «on the verge»? Alright, let`s add some numbers. Let`s look at data other than Rosstat, for a change. There`s an index called PMI (Purchasing Managers` Index), which has been calculated globally for a long time. It was first calculated in the USA during the Great Depression in the 1930s. The index is based on responses from purchasing and supply managers at large companies. The questions cover how respondents assess new orders from customers, annual production volumes, order levels, and the state of new hiring.

The PMI index is rightfully considered a very good leading economic indicator. That is, its values and dynamics can very accurately predict what will actually happen in the economy in a matter of months. Importantly, this opinion about the PMI index is based on many years of practice in numerous countries.

If the index value is above 50, the economy is doing well and growing. However, if it is below 50, business activity is slowing down. A recession is typically indicated when the PMI value ranges between 40 and 45 points.

So, what`s the current situation with this index for the Russian economy? The S&P Global PMI index for the manufacturing sector fell to 47.5 points in June 2025 (from 50.2 points in May). This is a significant decline and, as they say, on the verge. Besides manufacturing, the PMI index is calculated for the services sector. Here too, a decline was recorded in June: from 52.2 points in May to 49.2 points. Clearly, the composite index, covering both manufacturing and services, fell below 50 points, decreasing from 51.4 points in May to 48.5 points in June.

This presents a worrying picture. And one shouldn`t think that this index with a foreign acronym is somehow alien to us. Russia`s economic authorities closely monitor this index, which is calculated monthly, by the way. The PMI index is also important for the Bank of Russia, something it has never hidden. The index values are published monthly in reports by Russian state information agencies.

The conclusion based on the PMI index is obvious: the Russian economy shows a clear decline in business activity, and the risk of sliding into recession has become quite apparent.

What does this all mean? Rosstat data, the PMI index, analysis of ministerial statements – everything suggests that a transition of the Russian economy into recession is quite possible. For a complete picture, let`s also conduct a factor analysis of economic dynamics prospects. The question is: what has led to the slowdown in economic activity in recent months? In answering, let`s list these factors, though not necessarily in order of importance: the high key rate of the Bank of Russia, increased tax burden, and significant economic uncertainty.

What has changed? The Bank of Russia lowered the key rate in June of the current year from 21% to 20%. This is certainly positive. However, in terms of its impact on lending activity, little has changed, because when the rate is 20% or higher, a 1 percentage point reduction is practically imperceptible. Of course, this reduction is a positive signal, but not an effective measure. The tax burden in Russia increased from January 1, 2025 (including raising the corporate profit tax rate from 20% to 25%, introducing a real progressive income tax scale for individuals, etc.). And it is unlikely to decrease in the foreseeable future.

Economic uncertainty? Well, that`s completely off the charts. In fact, the very debate about economic cooling or the verge of recession fully confirms this. The factors listed above, which predetermine current economic trends, are not exhaustive. But even these are sufficient to conclude: the factor analysis also doesn`t yield a result that could be interpreted as the Russian economy is merely cooling down today. No, this is not just cooling. This is cooling that, as Maxim Reshetnikov said, has already brought the economy to the brink of recession.

However, even if we cross this threshold and slide into crisis, it doesn`t mean we shouldn`t try to reverse the situation: not raise taxes, but rather lower them; significantly reduce the Bank of Russia`s key rate further, despite the obvious surge in inflation happening this July due to sharp increases in utility payments; not weaken efforts to reduce excessive economic regulation; try to lower the level of economic uncertainty… This doesn`t guarantee that recession can be avoided, but it would at least give us the right to claim that much was done to achieve this goal. And whether this «much» will be sufficient for an effective anti-crisis policy – only time will tell.