Russia`s GDP growth rates have significantly dropped, aligning with analysts` expectations.

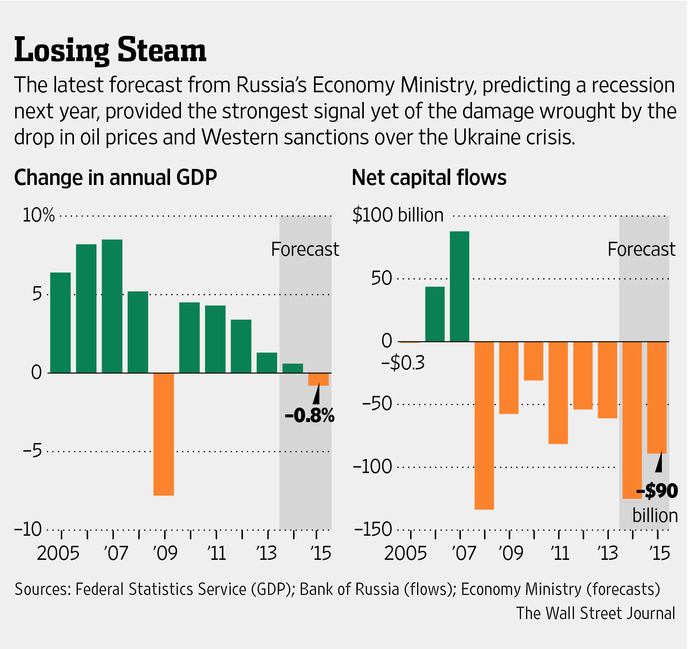

The Russian economy is rapidly approaching a standstill. According to the Ministry of Economic Development, the annual GDP grew by merely 1.1% over seven months, with July`s figure falling to 0.4% from 1% in June. It is evident that the economic boom experienced by many sectors in 2023-2024, largely fueled by trillions of rubles in budget stimulus, has nearly dissipated. At present, a scenario of the national economy sliding into recession seems quite plausible.

The government, however, remains optimistic, projecting GDP growth of over 1.5% by year-end, a forecast confirmed by Finance Minister Anton Siluanov during a recent meeting with President Putin.

Nevertheless, a clear trend of significant deceleration is apparent: according to the Ministry of Economic Development, the economy expanded by 1.2% in the first half of the year, but for the January-July period, growth was only 1.1%. The July figure of 0.4% represents a substantial slowdown—an 11-fold decrease compared to December 2024 (4.5%) and a 2.5-fold decrease compared to June (1%).

A sectoral breakdown paints an even more striking picture: industry is on the verge of stagnation with 0.7% growth; the production of motor vehicles, trailers, and semi-trailers declined by 26.5% in July (year-on-year); machinery and equipment by 11.9%; furniture by 12%; leather and leather products by 10.4%; tobacco products also by 10.4%; clothing by 7%; and electrical equipment by 6.5%. Metallurgy saw a 10.2% decrease.

According to Rosstat, corporate profits continue to shrink. From January to June, the net financial result in the economy decreased by 8.4% year-on-year. Industrial enterprises` investment plans are deteriorating, primarily, as business representatives note, due to the Central Bank`s stringent monetary policy (MP).

Even with the Central Bank having twice lowered the key rate to 18%, the real interest rate (after accounting for inflation) still exceeds 10%. According to Vedev, the regulator`s leadership should have held an unscheduled meeting in August to ease monetary policy, rather than going on vacation. Overall, the GDP situation will generate risks, primarily in the form of income stagnation, a decline in living standards, and rising unemployment.

The discussion is no longer about the risks of stagnation: for developing countries (like Russia), stagnation means 2-3% growth, and for industrialized nations, around 1%—always above zero. However, the Russian economy faces a potential decline into negative territory, and reversing this process is unlikely to succeed, Nikolaev believes. Lowering taxes is not an option, given the current budget shortfall. On the contrary, the fiscal burden will increase, despite government promises not to resort to systemic measures like a 5% increase in corporate profit tax in 2025. Administrative pressure on businesses will also intensify; there is a clear trend towards tightening regulations, for example, the list of cases for unscheduled inspections has been expanded. Oil prices are clearly not at desired levels and will not support the budget.

Alexey Vedev, Doctor of Economic Sciences, comments: «This is what was expected. The economic trajectory was clear to many even earlier; the discussion in expert and government circles revolved solely around forecast figures. The slowdown has been truly significant. The Bank of Russia`s estimate of 1.8% GDP growth in the first half of 2025 proved overly optimistic. The current 1.1% annual growth and July`s 0.4% are at the level of statistical error. In essence, the economy has stalled. This is also confirmed by business surveys: everyone is cutting costs, and salary increases for employees are not even being discussed. Furthermore, there`s a widespread drop in demand. The Ministry of Economic Development anticipates 1.5% GDP growth by year-end, but it`s unclear how the economy will accelerate to that extent, given the current 1.1% growth and the persistently tight monetary policy.»