Nabiullina: «We need time to solidify the disinflationary trend»

The Bank of Russia`s Board of Directors considered only two options for the key interest rate: maintaining it or reducing it by one percentage point. This revelation from Elvira Nabiullina was perhaps the biggest surprise during her September meeting with journalists. Previously, financial analysts had almost unanimously asserted that a rate cut was inevitable, predicting either a substantial two-percentage-point reduction or a minimal one.

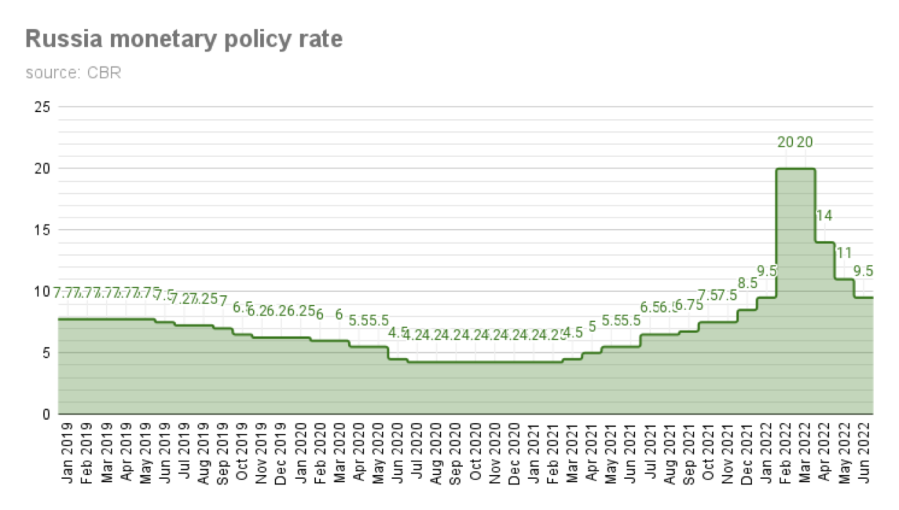

Ultimately, a highly restrained, compromising, and telling decision was made. The current rate of 17% per annum indicates the regulator`s clear and well-justified caution. Indeed, the trend towards monetary policy easing, established several months ago, persists, primarily due to slowing economic activity, external demand, and inflation.

However, pro-inflationary risks have not disappeared. Inflationary expectations remain elevated across all groups – households, businesses, and financial markets. Corporate lending has accelerated, and crucially, there is uncertainty about the future of the budget, the budget deficit, and government decisions, especially regarding expenditures.

It is certainly positive that vegetable and fruit prices sharply decreased in July-August, and the cost of foreign tours, hotel services, and certain food products declined «more than usual.» «If we strip out seasonal factors, price growth was about 4% on an annualized basis. However, this does not mean we have achieved our goal… We need time to consolidate the disinflationary trend,» Nabiullina remarked, also noting the double-digit indexation of utility tariffs in July, the summer surge in gasoline prices, and how such factors traditionally fuel inflationary expectations.

Among other key points raised by the head of the Central Bank were: «the assertion of a technical recession in the Russian economy is debatable, but there is a cooling down»; «the economy will continue to grow this year and next, albeit at a slower pace»; «attempts to accelerate economic growth without balancing supply and demand will lead to increased inflation»; «consumer demand intensified in July-August»; «demand for cars and housing is growing»; «the key factor for the availability of credit for businesses is low inflation, and rate reduction is not a quick process»; «savings activity remains high, supported by rising household incomes.»

Regarding the ruble`s exchange rate, Elvira Nabiullina noted that its dynamic is an «important indicator of the rigidity of monetary policy.»

A central theme of the press conference, predictably, was the current federal budget deficit, which reached 4.19 trillion rubles, or 1.9% of GDP, from January to August. This question was posed repeatedly (other topics seemed more like side dishes to the main course), and it was here that the impulses from media representatives converged with the undisguised concern of the Bank of Russia`s leadership.

«If the budget deficit is higher than in the Central Bank`s baseline scenario, this will limit the possibility of further rate cuts,» stated the head of the regulator. According to her, the Bank of Russia expects that budget expenditures in 2025 and the treasury parameters for 2026-2028 (which the government will present by the end of September) will have a disinflationary effect.

Nabiullina was asked whether it is realistic to achieve the Central Bank`s declared inflation target of 4% next year, given the steady trend of government spending, which has grown by 20% over the last three years.

«Of course, much depends on fiscal policy,» Nabiullina responded, reflecting her team`s fundamental position. «What matters is not so much how much expenditures grow, but rather the budget deficit. If additional government expenditures are covered by an increase in tax revenues, it is neutral for inflation and interest rates, as it does not create additional demand. However, if additional expenditures are not covered by taxes and the budget deficit grows, then the budget`s contribution to aggregate demand also increases.

Consequently, to achieve a 4% inflation rate, the contribution of credit must decrease, meaning rates would need to be higher. The Bank of Russia can achieve the 4% inflation target, but at higher rates if the budget deficit continues to grow. Lending to the private sector of the economy operates like a system of communicating vessels: the more money the economy receives from the budget, the less it receives through credit, and vice versa.»

An «MK» correspondent raised the issue of rapidly falling bank deposit rates, currently in the 12-15% annual range. This has sparked speculation that people urgently need to seek alternative savings options. Does the Central Bank monitor the justification of banks` actions? Will such behavior not cause a sharp outflow of money from deposits and mass consumer panic?

«We fully understand that for deposit rates to remain attractive, they must compensate for future inflation,» Elvira Nabiullina noted. According to her, when making monetary policy decisions, the regulator monitors deposit rate dynamics, striving to ensure that they protect savings from inflation. However, the Central Bank does not interfere in banks` interest rate policies, as «this is a market process.»