Analyst Vladimir Chernov attributes the sharp decline to a stronger ruble and lower oil prices.

Photo: Lilia Sharlovskaya

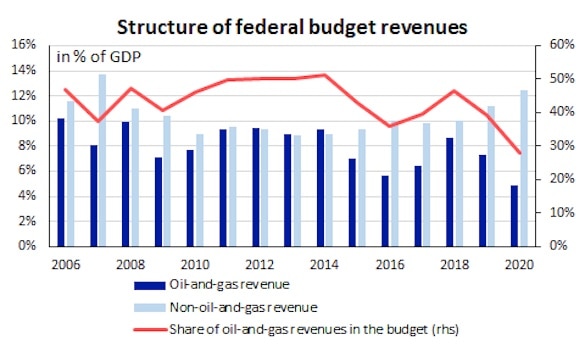

According to the Ministry of Finance, Russia`s oil and gas revenues experienced a significant year-on-year drop in August, decreasing by over a quarter to 505 billion rubles from 675 billion a year prior. This marks the lowest figure for both the current year and the entirety of 2024. From January to August, total oil and gas budget revenues also saw a notable reduction of more than 20%, totaling 6 trillion rubles. Given that the Russian federal budget remains heavily reliant on export earnings from oil and gas trade, questions arise about the severity of this decline, its potential risks to the budget, and possible solutions. Vladimir Chernov, an analyst at Freedom Finance Global, offered his insights on these critical issues.

What caused such a sharp drop in oil and gas revenues in August?

The primary reason for this decline is the reduction in taxes on oil and gas condensate extraction, which brought in 620.6 billion rubles, a 32% decrease compared to the same period last year. Gas collection revenues saw an especially sharp drop of nearly 48%, from 162.6 billion to 84.7 billion rubles. Additionally, the fall in oil and gas revenues in August is linked to lower global oil prices compared to the previous year; the average Brent crude price last month was $69 per barrel, 12.7% lower than the approximately $79 per barrel in August 2024.

Did the ruble`s exchange rate play a role in this situation?

Yes, the ruble`s exchange rate significantly contributed to the decline in oil and gas revenues in August. The average dollar value decreased by approximately 9% compared to August of last year, from 88 to 80 rubles. Further contributing factors include ongoing sanctions pressure on logistics, discounts on raw material sales to Asia, and a reduction in physical gas export volumes due to companies reorienting towards the domestic market and a ban on gasoline exports.

How risky is this for the federal budget?

This trend of declining oil and gas revenues, which became more pronounced in August compared to the 15-18% decreases seen in June and July, intensifies the risk of a federal budget deficit in the second half of the year. With a planned annual oil and gas revenue target of 11–11.5 trillion rubles, a 20% shortfall equates to approximately 2.2 trillion rubles. This compels the Ministry of Finance to more actively utilize the National Wealth Fund, increase domestic borrowing, and boost the share of non-oil and gas revenues, primarily through higher tax burdens on domestic businesses and consumption.

What is your forecast for revenues until the end of the current year?

Oil and gas revenues are expected to remain under pressure until the end of 2025, particularly during the autumn-winter period when gas exports to Europe will not be able to offset the reduced volumes of previous years. With a moderate recovery in oil prices to $70–80 per barrel, revenues may partially stabilize, but it is unlikely they will return to 2022–2023 levels even under such circumstances.

Does this mean the budget deficit will further increase from the current 4 trillion rubles?

Yes, according to our forecast, if the current situation persists, the budget deficit could reach at least 5 trillion rubles by the end of 2025, which is roughly 2.2–2.3% of GDP. In the event of additional expenditures, increased sanctions pressure, or a further decline in oil and gas revenues, this figure could potentially rise to 5.5–6 trillion rubles, amounting to approximately 2.5% of GDP. Thus, by year-end, the government will face the challenge of balancing expenditures through domestic sources and a more conservative debt policy.