Experts discussed how oil prices might change.

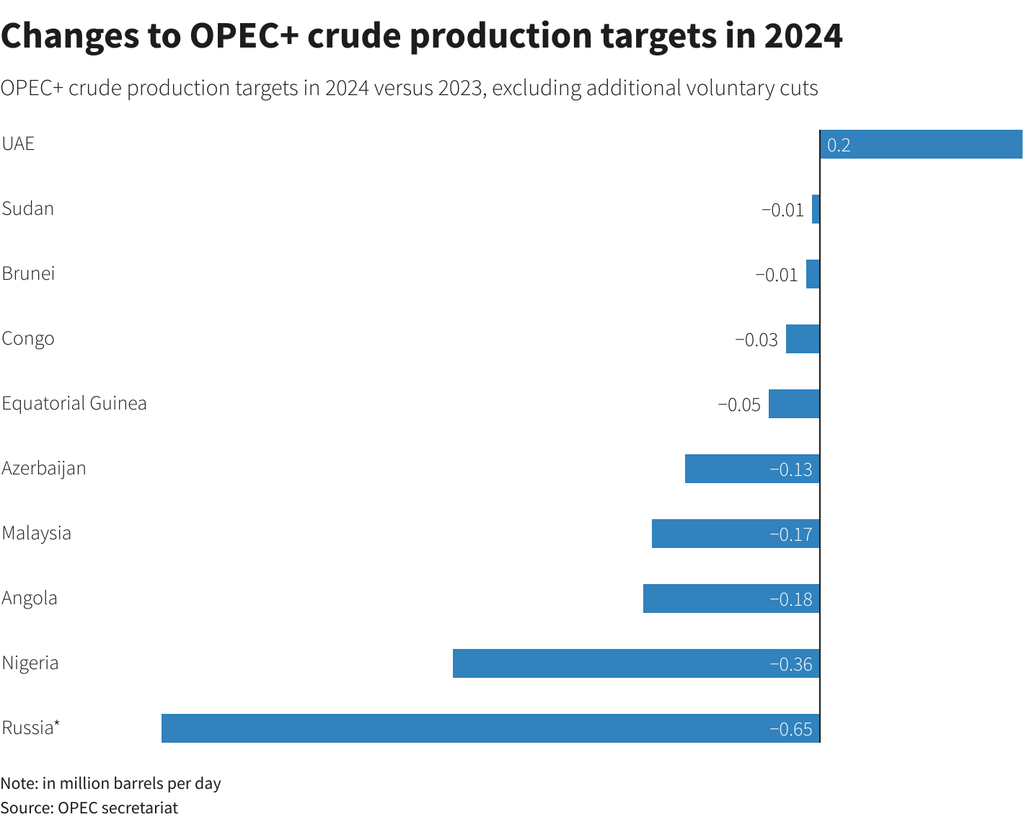

Although there is an increasing amount of oil on the global energy market daily, barrel prices, hovering around the $70 mark, are not showing signs of falling. Neither the OPEC+ decision to increase production capacity again nor the worsening situation in the Middle East have yet managed to destabilize the barrel price. However, it is unwise to assume this trend will continue – the raw materials markets are likely to face new challenges in the near future, disrupting the relative stability of revenues for major energy exporters. Russia is currently navigating a difficult balance between dwindling hydrocarbon export earnings and the need to strengthen trade relationships with fuel importers.

The past week, following the expected directive from OPEC+ to increase oil production by nearly 550 thousand barrels per day in August, did not bring unpleasant surprises to the global energy market. Importers of «black gold» increased daily purchases of raw materials shipped via sea by approximately 400 thousand barrels, which provided decent support for oil prices, with exchange rates not dropping below the psychological $70 per barrel mark. According to OPEC Secretary General Haitham al-Ghais, strong global economic growth, projected at around 3% this year, will continue to support high demand for oil. Based on current rates, consumers are expected to increase daily purchases in the coming years, allowing suppliers to gradually increase production by 18.5%. However, this is a long-term outlook, spanning a quarter of a century. In the foreseeable future, there are forecasts for a decline in oil demand between 2026 and 2029 in the most sought-after markets in Asia and Europe.

Despite declining revenues from energy sales abroad, Russia continues to focus on the potential for positive export returns from its raw materials sector. Deputy Prime Minister Alexander Novak believes that with the increase in the number of vehicles in countries in the Asia-Pacific region, Latin America, and Africa, hydrocarbon purchase volumes could rise by over 10 million barrels per day in absolute terms over the next decade.

Experts surveyed by «MK» offer varying explanations for the policies of major energy producers, but generally agree that the state of this sector will determine Russia`s influence on the entire global economic model.

Q: What prices should we expect after the latest OPEC+ production increase? Can we forecast the average price per barrel for the year?

Vasily Girya, CEO of GIS Mining: Given the current consumption level and in the absence of sharp macroeconomic shocks, the average annual price for Brent could remain in the $66-72 per barrel range. At subsequent meetings, the alliance will likely be more cautious regarding quota revisions and aim to avoid abrupt decisions that could increase market volatility.

Dmitry Alexandrov, Head of Analytical Research at AVI Capital: OPEC+ countries are compelled not only to monitor prices but also to fight for market share. Therefore, increasing output when non-alliance nations are also expanding production is a relatively sensible maneuver. Currently, the consensus is on increased consumption of «black gold» in several global regions, including China. Some major analytical centers are now raising their forecasts for average annual barrel prices. Moving forward, based on market monitoring, OPEC+ will make more balanced decisions on adjusting quota parameters. It`s possible that production growth could be tempered if consumption volumes decrease.

Igor Rastorguev, Lead Analyst at AMarkets: For Russia, which will also join the global trend and increase oil production, the collective OPEC+ decision to raise output has a largely positive effect. The lower the price of Brent crude, the smaller the price difference relative to the Russian Urals grade. In the long term, raw material prices are expected to rise, as hydrocarbon reserves are currently at minimal levels, confirmed by regular US inventory statistics.

Q: In June, Russia`s oil and gas revenues dropped to their lowest level since January 2023. If prices continue to fall, how much more could the country`s oil export revenues suffer?

Girya: Deputy Prime Minister Novak`s comments supporting increased production should be viewed in the context of Russia`s desire to maintain and strengthen its market share. This is particularly evident as other raw material exporters make energetic returns. The decline in Russia`s oil and gas revenues in June is partly due not only to price dynamics but also to changes in payment terms and logistics. Increasing production could be an attempt to compensate for falling prices through higher export volumes. This might work in energy-surplus regions with stable demand.

Vladimir Chernov, Analyst at Freedom Finance Global: Russia`s stance on continuing to boost production appears to be an attempt to increase export volumes amid low prices and falling oil and gas revenues. In June, Russia`s oil and gas budget revenues neared lows seen since the start of the sanctions period, causing significant concern. However, betting on volume growth while prices are falling is, in my opinion, a quite risky strategy because if quotes indeed drop to $65 or lower, it won`t offset the export increase, especially considering the discount to Brent and logistical costs. Therefore, Russia can only count on a short-term increase in foreign exchange earnings. With further declines in oil prices, losses could worsen. Russia`s current position on oil production is justified only as a gamble within a temporary window, while geopolitical and macroeconomic risks are holding back the fundamental reasons for rising energy prices. If Brent quotes fall below $65 again, and Urals cost, including discount, drops back to the $50-55 range, Russia`s oil and gas revenues risk returning to the minimum values seen since June 2023.

Q: Donald Trump expressed confidence that, given favorable market conditions, the US could lower oil prices to replenish the national strategic petroleum reserve. Does the OPEC+ decision to increase output contradict the interests of the alliance members, including Russia?

Girya: The US desire to replenish strategic reserves amidst potential price declines partially aligns with OPEC+`s tactical interests, as key alliance members want to keep the market balanced and prevent excessive price increases. However, in the long term, the interests of exporters and importers may diverge again, which will be reflected in OPEC+`s rhetoric and decisions.

Chernov: The decision by OPEC+ to increase production appears somewhat contradictory in light of Trump`s statements. If the alliance continues to saturate the market, it will maintain downward pressure on prices, which benefits import-oriented economies but not hydrocarbon exporting countries, including Russia and Saudi Arabia. This divergence of interests within OPEC+ could intensify, especially if increased production doesn`t lead to the expected market share recovery. Additional barrels already increase the risk of a global `black gold` surplus and require caution. It`s crucial for the alliance not to overestimate the market`s capacity and avoid triggering a price collapse.