Russian State Advisor Sevostyanov expects oil price jump due to escalation in the Middle East.

Q: Numerous sources provide information on the oil situation, yet analysts universally agree that forecasting is currently very challenging due to ongoing geopolitical interference in markets. How should we understand the current dynamics?

A: Today, we are observing structural shifts in the oil market. The primary drivers of demand and supply that dominated the last 15 years are changing, or more precisely, weakening. Generally, analysts` outlooks align with the International Energy Agency`s: China, the main engine for global oil demand growth for over a decade, is expected to reach peak consumption around 2029. This is attributed to increased electric vehicle sales and the expansion of high-speed rail and natural gas-powered trucks.

Q: Are there any specific forecasts for the immediate future, perhaps analysts` expectations for the end of the year?

A: Global oil consumption is projected to increase by 720,000 barrels per day in 2025. Meanwhile, supply rose by 330,000 barrels per day in May, reaching 105 million barrels per day – 1.8 million more than a year ago. Both non-OPEC+ countries and the OPEC+ group are contributing relatively evenly to this growth in production and demand as voluntary output restrictions are relaxed. Simply put, global oil supply in 2025 could outpace world demand, resulting in a surplus. Inventories are likely to grow despite regional risks. The current surplus is estimated at around 1.1 million barrels daily. The main factors driving this oversupply are increased production in the US and OPEC+ nations alongside moderate demand from China and the EU.

Q: How does the conflict in the Middle East influence oil quotations?

A: In 1973, when Arab countries imposed their embargo, oil prices quadrupled. This «oil shock» – marked by long gas station queues, inflation, and recession – is now a historical case study. Today`s situation is different, but the echoes of the past are becoming louder. I would describe the current market state as «nervous stability.» After an initial spike in Brent crude to $78 on the day of attacks, prices settled back around $74.60 by June 17, a marginal 1.87% rise. Three factors explain the absence of a significant surge: key Iranian export infrastructure remains intact (maintaining a 3.4 million bpd flow), OPEC+ holds substantial spare capacity (Saudi Arabia has 3 million bpd as a market «fire hydrant»), and demand is somewhat subdued, with Chinese imports falling in May and EU industry remaining stagnant. However, markets react based on expectations, not just current data. As the American investor Warren Buffett noted, the market is a pendulum swinging between greed and fear. The pendulum is now visibly tilting towards fear. The developments of the upcoming week will be critical.

Q: What will happen to oil prices in a worst-case scenario?

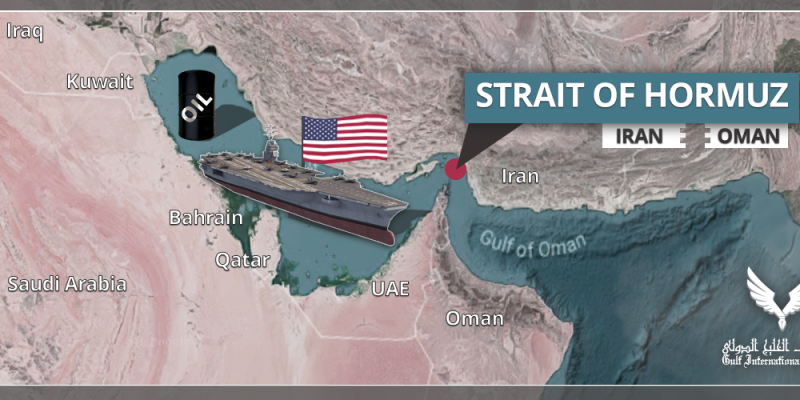

A: If the Strait of Hormuz were closed or Saudi Arabian export facilities were attacked, prices could easily surge above $110. I estimate the probability of this high-risk scenario at around 30%. It would likely necessitate the physical destruction of Iranian oil infrastructure and a prolonged blockade of the Strait. The Strait of Hormuz is a crucial, narrow waterway connecting the Persian Gulf to the Indian Ocean. Approximately one-third of seaborne crude oil exports and 20% of global liquefied natural gas pass through this channel, which borders Iran to the north. However, widespread panic driving prices even higher would likely be mitigated by strategic petroleum reserves totaling 1.5 billion barrels, which could stabilize the situation. Therefore, supply continuity is paramount. As long as supplies are not significantly disrupted, I do not anticipate sharp oil price spikes. The scale of U.S. actions serves as an indicator of the conflict`s potential intensity; a full-blown regional war, as is known, typically involves deploying three aircraft carrier strike groups.

Q: Will the European Union now postpone its plans to lower the price cap on Russian oil from $60 to $45 per barrel as part of stricter sanctions?

A: This idea was discussed in the EU earlier this year. However, I believe these plans will be deferred following the escalation in the Middle East. The reason is simple: no one in Europe desires another oil shock. Thus, Iran and Israel, perhaps inadvertently, have provided a form of «geopolitical breathing space.» The focus is currently on the Persian Gulf.

Q: Will the EU fundamentally alter its overall policy towards Russian oil due to events in the Middle East?

A: At this stage, it`s improbable that the European Union will significantly ease its sanctions policy concerning Russian hydrocarbons. Even amidst the worsening situation in the Middle East and rising oil prices, the EU will likely maintain its political stance of pressure on Moscow. Sanctions against Russian oil are not merely an economic measure but also a strategic matter tied to the EU`s position on Ukraine. Nevertheless, some practical adjustments are possible. For instance, the EU might overlook increased re-exports of petroleum products derived from Russian oil in third countries, primarily India and Turkey. The pace of tightening enforcement of the price cap could also slow down, especially if the oil market becomes volatile and Brent prices stabilize above $90 per barrel. In essence, the formal policy will remain, but practical pressure might subtly decrease – not as a gesture of goodwill, but as a means to stabilize Europe`s own energy situation. As former European Commission President Jacques Delors said, «Europe moves forward only in times of crisis – and then takes steps it hadn`t dared to take before.»

Q: So, what will be Europe`s position on the global oil market going forward?

A: Events in the Middle East have once again brought Europe`s energy security concerns to the forefront. While it`s unlikely the EU will drastically change its sanctions policy regarding Russian oil (maintaining its strategic goal of reducing dependence), the Middle East conflict, particularly the risks to the Strait of Hormuz, renders the oil market highly vulnerable. This vulnerability is already compelling Europe to adopt a more cautious approach. The EU continues its trajectory away from Russian oil, but the current geopolitical instability may temporarily slow down the tightening of sanction policy. This does not imply lifting restrictions, but new measures, such as lowering the price cap or expanding secondary sanctions, might be postponed. Brussels fully understands that adding further pressure would trigger price spikes, primarily harming European consumers. Therefore, as one European diplomat noted, «the time for new decisions must be chosen wisely.» Events in the Middle East are acting as a restraint, especially given the increasing strategic uncertainty in global supplies.

Q: How will all these developments affect Russia`s budget?

A: The situation involving Iran and Israel undeniably introduces additional turbulence into the oil market. However, for the Russian budget, this is less of a threat and more of a potential opportunity. On one hand, the price cap on Russian oil is still formally in effect, limiting export possibilities beyond the set limit. But, as demonstrated by recent months, amidst a global oil supply deficit and rising risk premiums, the actual price for Russian oil is increasingly nearing market rates, particularly for shipments directed towards Asia. Russia`s budget system has been restructured since 2023 into a more flexible model where oil and gas revenues are significant but no longer play a critical role. The basic level of stability is achieved through a conservative fiscal policy, strict expenditure control, and diversification of foreign economic partners. This provides a buffer of stability even when external markets are highly volatile. Nevertheless, if tensions in the Middle East persist, the price of oil could stabilize above $90 per barrel, which would directly boost budget revenues. Even with the existing price cap, Russian companies are finding logistical and legal avenues to sell oil. Overall, the crisis in the region is more likely to strengthen Russia`s current budget structure than to destabilize it. Every oil crisis reinforces the same lesson: oil is not merely a resource; it is a vital nerve of the global economy. While we are not replicating 1973, when the Middle East flares up, we certainly start moving closer to that reality.