The Central Bank announced that its foreign exchange reserves have hit an all-time high.

As reported by the Central Bank, Russia`s international (gold and foreign currency) reserves have grown to a historically record level of $690.6 billion. On the one hand, this is a positive sign, indicating that the domestic economy and financial system maintain stability in a very difficult situation. At the same time, the average person might wonder: what is the benefit of this achievement amidst the steady increase in state spending on defense, social needs, and covering the budget deficit?

In 2024, Russia`s international (or gold and foreign currency, FX) reserves increased by 1.8%, totaling $609.1 billion as of January 1. By year-end, Russia ranked seventh globally in terms of FX reserve growth. China was the absolute leader, increasing its reserves by $263.3 billion.

FX reserves serve as a state`s financial safety cushion. They are highly liquid foreign assets, including monetary gold in bars and coins, foreign currency funds (primarily non-cash), securities, and Special Drawing Rights (SDRs, issued by the IMF and based on major international currencies: US dollars, euros, yen, yuan, British pounds). The structure of Russia`s FX reserves has changed rapidly since 2022. According to Finance Minister Anton Siluanov, Chinese yuan and gold now form the core of the reserves. Additionally, the state prioritizes acquiring currency and debt securities from countries that have not joined sanctions against Russia.

Countries that are net exporters of raw materials with non-reserve currencies traditionally hold large FX reserves. Russia is a prime example. For Russia, the volume of international reserves is largely a reputational indicator of financial stability and creditworthiness. In practical terms, FX reserves help smooth balance of payments shocks and currency rate fluctuations, reduce dependence on unstable external capital flows, cover the country`s external debt, facilitate overcoming crisis moments, and stimulate the economy during difficult periods. The geographical locations for storing Russia`s FX reserves in foreign currency, according to the Central Bank, include the US, China, Japan, Great Britain, France, Germany, Austria, and several other countries and organizations.

Without knowing all this, some might ask: «Why aren`t these hundreds of billions of dollars in FX reserves used for the benefit of the domestic economy, for example, invested in infrastructure projects?» However, this question is based on a misunderstanding.

«One must not forget that in 2022, a portion of the Central Bank`s international reserves, specifically assets and securities in several countries valued at approximately $300 billion in dollar equivalent, were frozen by the West,» says Igor Nikolaev, chief researcher at the Institute of Economics of the Russian Academy of Sciences. «Apparently, judging by the dynamics of inflows, these assets are part of the $690.6 billion figure recently announced by the regulator. It`s also worth noting that international reserves and the National Wealth Fund are essentially two facets of the same whole, like communicating vessels (funds are reflected as `double accounts` in financial documents). The difference is that FX reserves are primarily intended for international settlements, while the liquid assets of the NWF are for resolving internal financial issues, particularly fulfilling budget obligations.»

Therefore, it cannot be said that FX reserves, whose volume grows due to inflows into the NWF, are not used for the economy`s needs. On the other hand, Nikolaev concludes, the significance of the record $690.6 billion figure should not be overstated.

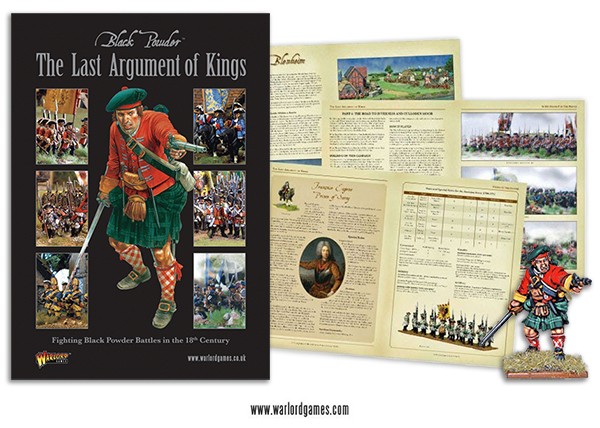

«The main function of international reserves is to ensure the state`s financial stability, a kind of `last argument of kings`,» explains Nikita Maslennikov, a leading expert at the Center for Political Technologies. «Difficult times are ahead, as Central Bank head Elvira Nabiullina recently stated, referring to various possible scenarios. One is, naturally, increased sanctions pressure on Russia from unfriendly states. The second is further fragmentation of the world economy and its breakdown into several blocs. Clearly, in these conditions, monetary stability will be determined by the level of FX reserves. Our Central Bank is not alone in its actions: central bankers everywhere, being conservative, are accumulating assets, primarily physical gold, for a `rainy day`.»

Precious metals remain one of the few assets that can guarantee some financial security amidst the sharp deterioration of the global market situation. It`s noteworthy, the interlocutor points out, that silver prices are also starting to rise. Its inclusion in FX reserves is currently a working hypothesis, but analysts predict that global regulators will begin buying silver in a year or two, following private investors. According to Maslennikov, the composition of FX reserves is also important. The smaller, dollar-denominated portion cannot be used by the Russian state even purely technically. It`s a different matter with yuan, which form the basis of the NWF. Thus, the $690.6 billion sum should not be too impressive: the lion`s share is a safety cushion for extreme circumstances, intended to ensure international settlements in a crisis situation.

«Investing these funds in industry, thereby creating a credit boom, would mean further escalating inflation, which is already off the charts through both the budget channel and the banking sector,» says Maslennikov. «The economy definitely doesn`t need an additional impulse that would accelerate inflation! As for the question of whether Russia`s frozen assets of $300 billion are included in the aforementioned $690.6 billion, that should be addressed to the Central Bank. Formally, they should be included, as these assets have not been confiscated but blocked.»