The Russian government has introduced a comprehensive set of proposals aimed at refining the national tax system.

The government recently endorsed a package of legislative initiatives, encompassing revisions to the 2025 federal budget, a new federal budget for 2026 through 2028, and amendments to the Budget and Tax Codes. These changes are poised to reshape Russia`s fiscal landscape.

The expenditure priorities for the 2026-2028 budget are clearly defined: fulfilling all social commitments to citizens, ensuring national defense and security, providing social assistance to families of special military operation participants, and achieving the national goals set by the President of the Russian Federation for the period up to 2030.

Notable social sector innovations include an annual family payment (a partial refund of personal income tax paid) for Russian citizens with two or more children who meet specific income eligibility criteria. Furthermore, the existing maternity capital and family mortgage programs will continue to operate until 2030.

A cornerstone of budget planning continues to be the financial support for national defense and security, alongside the government`s steadfast commitment to social aid for families involved in the special military operation.

The budget also prioritizes stimulating technological advancement and infrastructure modernization. This section includes several significant initiatives, such as substantial funding for the new national project «Means of Production and Automation» (launched in 2025) and the ongoing national project «Unmanned Aircraft Systems» (launched in 2024).

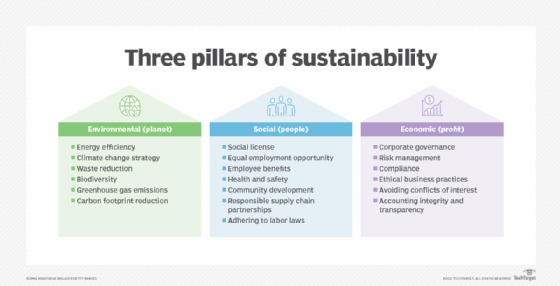

Crucially, a series of proposals aim to refine the tax system, specifically to level the competitive playing field for legitimate businesses.

Firstly, the income threshold for VAT liability under the simplified tax system (STS) will be significantly reduced from 60 million rubles to 10 million rubles annually.

Currently, a detrimental economic trend is evident: simplified tax regimes, particularly for individual entrepreneurs (IEs), are increasingly being exploited as a means for larger businesses to optimize their tax burden and manage cash flows. This is most pronounced in marketplace trade, where unscrupulous sellers employ numerous legal entities and «nominal» IEs to maintain tax advantages. This trend is corroborated by industry data for small and medium-sized enterprises (SMEs); while e-commerce SMEs constituted less than 10% of all SMEs in late 2021, this figure climbed to 20% by early September 2025.

The current disparity in VAT taxation between businesses on the simplified tax system and large enterprises invariably encourages various «business fragmentation» schemes designed to reduce tax liabilities. The IE status has gradually transformed into a «tool for specific purposes,» such as circumventing regulatory restrictions or formalizing staff employment while maintaining an individual status. Instances of formal business splitting through networks of affiliated IEs are widespread, enabling large organizations to optimize costs. For example, in Q1 2025, the Russian Federal Tax Service (FTS) recorded a record number of business fragmentation cases among major road carriers in Russia, involving 440 shell companies participating in tax evasion and cash-out schemes.

Secondly, the Russian Ministry of Finance proposed mandating organizations to calculate social insurance contributions for executive payments based on at least the minimum wage. This measure aims to curb widespread tax evasion schemes involving fictitious salaries and «zero» accruals.

Collectively, these measures are not intended to complicate business operations but rather to prevent the exploitation of loopholes in tax legislation. This will help standardize the «rules of the game» by eliminating the economic benefits of various illicit schemes.

The Ministry of Finance also proposed new parameters for social insurance contribution rates for SMEs. Priority SME sectors (including industry, manufacturing, transport, and electronics) will retain reduced contribution rates, while other sectors (trade, construction, mining, etc.) will revert to general rates (30% up to the maximum base and 15% above it). Coupled with increased tax burdens on the gambling industry, these measures are expected not only to boost federal budget revenues but also to align with the broader strategy for structural changes in the Russian economy (part of the President`s directives following the SPIEF 2025 results), prioritizing support for high-tech sectors while optimizing operations in supporting industries.