Expert Yushkov: «Prices Could Collapse to $20 per Barrel in the Moment»

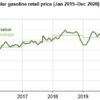

Russian oil continues its steady decline in price, mirroring global benchmarks. In June, the average price for the Urals grade, which is used for calculating raw material taxes, fell by nearly 14% year-on-year to $59.8 per barrel, according to data from the Ministry of Economic Development. The outlook for the Russian budget appears quite concerning, given the significant role of oil and gas revenues in its formation and in financing the deficit, which reached 2.59 trillion rubles in the first half of the year.

In June 2024, the average price of the Urals oil grade was $69.58 per barrel, representing a total decrease of $9.74 over the past year. According to the Ministry of Economic Development, prices consistently fell below $55 in April and May, reaching $52.08 in May. Naturally, this price dynamic for Russian oil is primarily a reflection of the global market, where the benchmark North Sea Brent crude sets the tone.

Despite a brief surge due to the escalation of the Iran-Israel conflict (which temporarily pushed prices close to $80 per barrel), Brent has generally maintained its long-term downward trend. This trend was further intensified by growing market concerns about a potential slowdown in the global economy triggered by trade disputes initiated by Trump. Against this backdrop, the Russian federal budget`s tax revenues from oil and gas sales plummeted by 35% year-on-year in May, totaling 513 billion rubles.

«The situation with Urals prices is determined by the overall global market conditions,» explains Igor Yushkov, an expert at the Financial University under the Government of the Russian Federation, in a conversation with MK. «Russian oil continues to trade at a discount of $10-13 compared to Brent, which has significantly decreased over the year: it consistently stayed above $70 per barrel in 2024 but now fluctuates around $64. Regarding the consequences for the Russian budget, the picture is mixed. The initial budget plan, effective from January 1, set the average annual Urals price at $69.7 per barrel, suggesting a shortfall in revenue from that perspective. However, a revised version, approved in late April, uses a figure of $55, which allows the budget to stay within its targets.»

«Moreover, since the start of 2025, the Mineral Extraction Tax (MET) calculation includes the price of not only Urals but also ESPO, a low-sulfur Siberian grade that makes Russian oil generally more expensive. Consequently, according to this expert, `nothing terrible is happening.` Nevertheless, the new federal budget version features a higher deficit – 1.7% of GDP, compared to 0.5% in the initial calculations. Therefore, naturally, the higher the oil price (within reasonable limits, up to $100 per barrel), the more the state earns.»

What could be the future dynamics of Urals prices?

«Predicting events a year or more ahead is impossible. A great deal depends on the `Trump tariff` situation, primarily concerning US-China trade relations. Whether the parties reach an agreement, and on what terms, will determine the state of the global economy as a whole, and thus, the demand for oil and petroleum products. Another factor, which has recently emerged, is the Iranian one. If the United States reaches an agreement with Tehran on its nuclear program and eases sanctions on its oil industry, Iran could increase production and exports. Consequently, prices would rise. This scenario is unequivocally negative for Russia.»

«There is also a very real risk of the OPEC+ deal collapsing. Its participants have even had to increase production volumes to release pressure and appease those dissatisfied with the restrictions. There are also parties, like Kazakhstan, who ignore the agreements reached within OPEC+ by producing more oil. If the deal ceases to exist and everyone starts pumping at maximum capacity, a shock is unavoidable, and prices could temporarily plummet to $20 per barrel. The process of stabilizing and balancing the global market will take time, and the Russian budget will face a serious problem.»

Should the government change the oil cutoff price within the budget rule? As Anton Siluanov stated, this issue will be considered during the preparation of the 2026 budget. According to the head of the Ministry of Finance, the current level of $60 per barrel no longer meets the challenges of the time, given the volatility in the Russian and global energy markets.

According to the expert, changing the cutoff price would be absolutely logical, as a stable trend of decreasing Russian oil prices has emerged. Previously, for many years, it was guaranteed to be above $60 per barrel, but today, falling to around $50 and below has become common. Considering that the Ministry of Finance is tasked with strengthening the ruble (although this doesn`t increase budget revenues) by selling currency under the budget rule, this measure would provide the financial agency with more room for maneuver. From the perspective of replenishing the federal treasury, it is clearly called for. The expert believes the probability of the budget rule ultimately being adjusted is quite high.