Controversial White House tariff initiatives lead to market chaos.

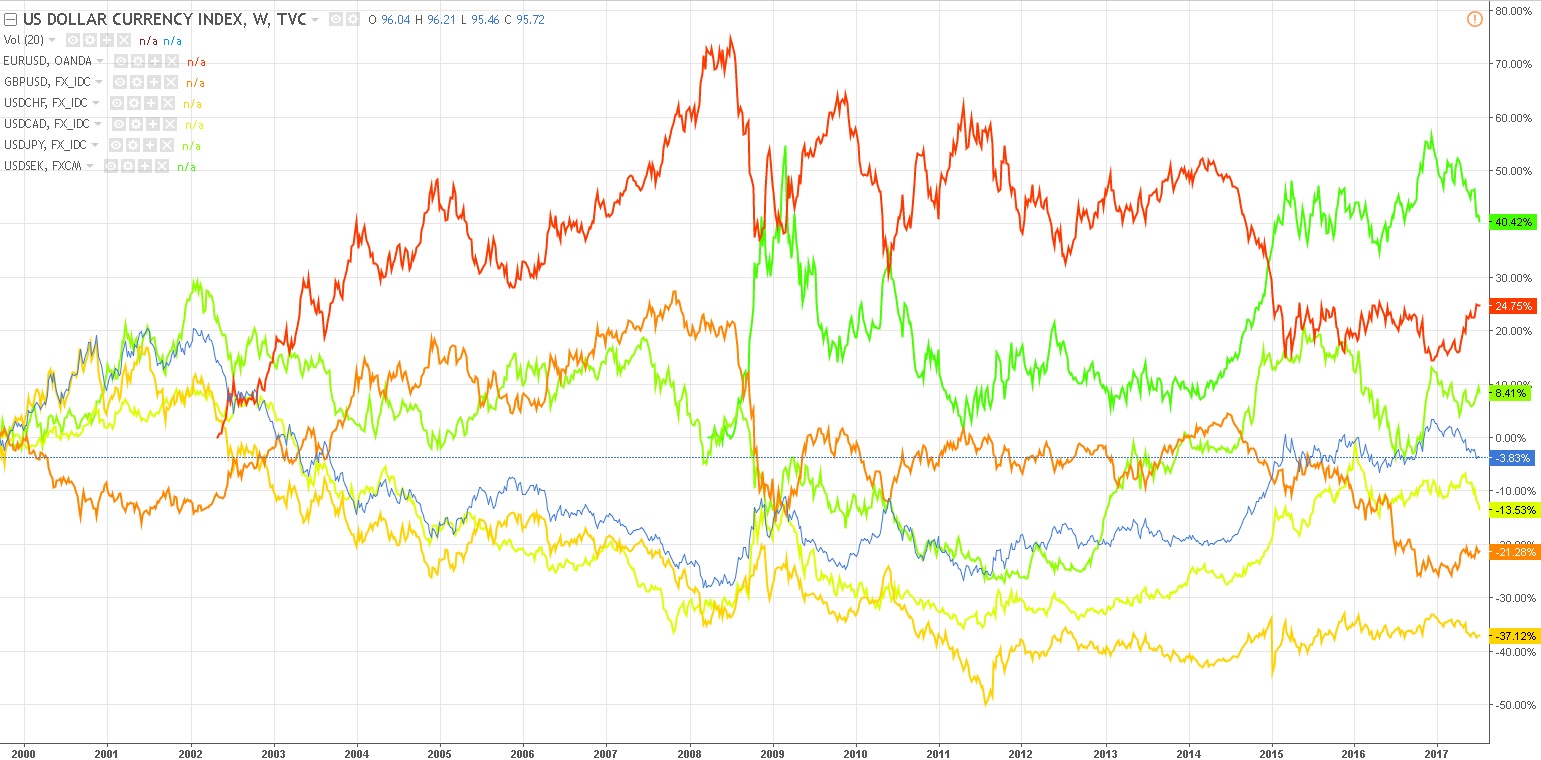

The phrase «The dollar has become a whipping boy in the unpredictable politics of Trump 2.0,» attributed to ING bank group analyst Francesco Pesole, accurately describes the situation the US currency finds itself in this year. According to the Financial Times, its index against a basket of global currencies (DXY) has fallen by 10% over six months, marking its worst performance since 1973, when it dropped by 15%. What does this trend mean for the Russian economy and the ruble`s exchange rate?

The White House`s controversial tariff proposals have resulted in market disorder and prompted investors to move towards European assets, particularly German bonds. Consequently, the euro has risen by 13% to $1.17, contrary to initial Wall Street forecasts that predicted its decline to parity with the dollar. While the dollar is not yet facing a loss of its reserve currency status, the Financial Times notes it is no longer viewed as a «safe haven.»

Simultaneously, the weakening dollar aligns with the ambitious plans of the Trump administration to correct the US balance of payments and eliminate the «gaping trade deficit» of $918 billion. Experts estimate this goal may require a 20-30% devaluation of the dollar over the next three years. Trump`s advisor, Stephen Miller, is convinced that an overvalued dollar makes US exports less competitive, increasing the country`s reliance on foreign goods, including military supplies.

This situation raises numerous questions, one of which directly concerns Russia: What does this mean for the ruble? To what extent is its sharp appreciation since January correlated with the dollar losing its global standing, and how interdependent are these two trends?

«When you chop wood, chips fly,» says Alexander Schneiderman, head of customer support and sales at Alfa-Forex, describing Washington`s current policy regarding the dollar. «Trump`s goal is to stabilize the national economy and boost goods exports. However, the methods chosen are quite peculiar. Primarily, the US President is actively combating the global de-dollarization process. He repeatedly announced this even before his election, threatening BRICS countries with tariffs if they continued to abandon the dollar for transactions.»

Furthermore, the initiative to boost domestic production and stimulate exports sounds good in theory, but in reality, 100% of modern products cannot be made in a single country. Imports are equally necessary for raw materials, technologies, and consumables. The motivation for manufacturers is supposedly provided by unprecedented tariffs imposed by Washington on its main trading partners – the EU, Mexico, Canada, and China. However, this risks a global surge in prices for nearly all goods. As the expert points out, the 90-day delay on implementing tariffs expired on July 9th. The expert believes the dollar`s future course will be determined by whether this delay is extended or the tariffs are implemented.

«By starting trade wars, Trump has nullified the potential positive effects of weakening the US national currency,» notes Igor Nikolaev, Chief Research Fellow at the Institute of Economics of the Russian Academy of Sciences. «Now he won`t be able to increase the competitiveness of American goods or strengthen his country`s position in foreign trade. In turn, the dollar and US financial markets, in general, are losing attractiveness in the eyes of investors. And considering Trump`s desire to remove Fed Chairman Jerome Powell from office, the dollar will continue to lose value. Regarding the ruble, its current strengthening is significantly linked to this trend. The prospect is quite unpleasant for the Russian economy: the budget will miss out on many billions in export revenues in ruble terms.»

According to Nikolaev, Trump`s unpredictability, constantly backtracking in his actions and rhetoric, carries the risk of the dollar`s course turning upwards and, consequently, a very rapid weakening of the ruble. This would benefit the Russian budget from a deficit financing perspective, but inflation could accelerate sharply. In that case, the Central Bank certainly wouldn`t lower the key rate; rather, it might increase it.

«In the short term, a weak dollar benefits US foreign trade by making American goods more affordable for foreign buyers, boosting exports, and reducing the trade deficit,» says Denis Astafiev, head of the fintech platform SharesPro. «But in the long term, it creates risks for macroeconomic stability and global confidence in the American economy.»

A prolonged decline in the exchange rate leads to more expensive imports and raw materials, which increases inflationary pressure and reduces the purchasing power of the population. Moreover, there are risks of the dollar losing its status as the main world reserve currency. This would complicate the financing of US national debt and lead to higher borrowing costs. Against this backdrop, Astafiev reminds, the ruble in 2025 became one of the fastest-strengthening currencies, gaining more than 15% against the dollar in six months. However, this current dynamic is unlikely to last long: if the Central Bank lowers the key rate and imports recover, the ruble`s rate could fall back into the 95–97 ruble range.

«For the Russian ruble, the situation with the dollar has been one of the external supporting factors, combined with the tax cycle, the foreign trade surplus, and sluggish importers,» believes Vasily Girya, CEO of GIS Mining. «Although the correlation with global dollar weakness is not absolute, it amplifies domestic trends. A strong ruble supports the modernization of high-tech sectors, including the IT sector and industrial mining: the park of computing equipment is actively being updated in Russia, and interest in localizing infrastructure is growing. At the same time, excessive ruble strengthening causes concern among exporters and reduces budget revenues.»