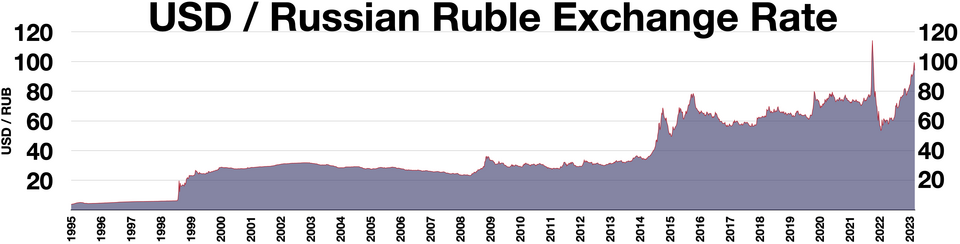

Should the Dollar in Russia Cost 80 Rubles or 100? Experts Disagree

At the St. Petersburg International Economic Forum (SPIEF), a debate emerged among prominent figures regarding the fair value of the Russian ruble. German Gref, head of a major state bank, argued that the current ruble rate is undervalued and its equilibrium level should be 100 rubles or higher against the dollar. In response, Andrey Gangan, Director of the Central Bank of Russia`s Monetary Policy Department, stated that the current market rate is the equilibrium rate, reflecting the objective economic situation. This article delves into this discussion with expert insights.

Author: Наталия Трушина

On the third day of SPIEF, financial sector representatives engaged in a debate about the ruble`s fair value. During a business breakfast with government officials and business leaders, German Gref asserted that the current ruble-dollar exchange rate does not reflect the real economic situation and is overvalued. «It is obvious today that the equilibrium ruble rate is `100 plus` against the dollar,» he explained. «Today we have a rate around 78-79 rubles per dollar. Our export industries and, primarily, the budget feel this very strongly.» He added that the current situation significantly burdens the government`s revenue, which is already facing a deficit.

Just hours later, a representative from the Central Bank of Russia, Andrey Gangan, offered a counterpoint at SPIEF. «The equilibrium ruble rate is not my opinion or anyone else`s; it is the result of supply and demand balance on the foreign exchange market,» Andrey Gangan stated. «The rate we see now is the equilibrium rate: it reflects the objective situation in the economy, even if it doesn`t align with expert opinions and desires.» The Central Bank official added that the current high key rate helps curb «overheated demand» and makes the ruble attractive. It contributes to the ruble`s strengthening and helps suppress inflation. He clarified that a weak ruble is indeed beneficial for domestic export companies as it helps them maintain profits under challenging external conditions. However, this does not mean such a ruble rate is optimal for the Russian economy as a whole. «The rate will be one that is consistent with low inflation, because everyone benefits from low inflation, both citizens and businesses,» Gangan concluded.

Expert Opinions

Experts believe the ruble debate is far from over and shared their perspectives on the fair rate with «MK».

Natalia Milchakova, Leading Analyst at Freedom Finance Global:

«In our view, the Central Bank`s representative voiced the most objective opinion. He spoke about the equilibrium ruble rate, which is formed on the foreign exchange market based on supply and demand. The ruble exchange rate in Russia is floating, and the Central Bank does not conduct currency interventions, so today, only the market can determine the ruble`s rate.»

«When someone states that the ruble is overvalued or undervalued, that its current rate is wrong and should be different, often no objective arguments are provided as to why, for example, the dollar should cost exactly 100 rubles, and not 101 or 99 rubles. Does it depend on oil prices, inflation, the Central Bank`s key rate decision, or something else? Therefore, such statements can only be considered someone`s personal point of view, while other opinions exist. The term `fair value` implies a market value influenced solely by supply and demand forces and no other subjective factors. However, the concept of `fair value` for any financial asset is increasingly confined to economic theory and has less relevance in practice, especially since the release of Nassim Taleb`s book `The Black Swan: The Impact of the Highly Improbable.` `Black swans` are non-market factors, often political, that can drastically change the `fair value` of any financial asset.»

«It is very difficult to talk about what ruble rate is `fair` today, as each economic entity understands the `fairness` of the ruble rate differently. A too-expensive ruble is disadvantageous for Russian exporters, so for them, the cheaper the ruble, the `fairer` it is. However, the public and businesses focused on the domestic market will have a completely different idea of a `fair` rate: they are quite satisfied with today`s strong ruble. We expect the dollar rate to be between 78-81 rubles, the euro between 89-92 rubles, and the yuan between 10.8-11.3 rubles by the end of June.»

Natalia Pyryeva, Leading Analyst at Tsifra Broker:

«Since the end of 2024, our forecasts have included ruble strengthening in the first half of 2025 and its subsequent weakening starting in the second half of the year. A stable and predictable ruble rate is important for the economy, and given Russia`s high share of export revenues, a weaker rate than the current one is beneficial.»

«In our assessment, there are no grounds to expect artificial measures aimed at weakening the ruble. The national currency rate will return to the 90-100 rubles per dollar range due to economic reasons without external intervention, whereas today a stronger rate helps cool inflation, which is the Central Bank`s most important task.»

«Today, the ruble is largely supported by high interest rates – exporters sell currency and accumulate free ruble liquidity in deposits to earn additional interest income. Simultaneously, the cooling of consumer demand due to increased saving sentiment and expectations of geopolitical normalization reduce importers` demand for currency. Thus, a surplus of foreign currency supply is formed in the market.»

«Achieving a ruble rate of `100 plus` per US dollar will not be critical for the economy if it moves in this direction in a planned and predictable manner. We believe that the ruble may indeed approach the 100 rubles per dollar mark by the end of the year. In July, factors favoring stabilization at current levels of 77-81 rubles per dollar will persist, with potential for weakening past 85 rubles per US dollar closer to autumn.»

Vasily Girya, CEO of GIS Mining:

«Statements about an `equilibrium` rate in the 100+ rubles per dollar range are very telling. They reflect the concerns of export-oriented industries – a strong ruble does indeed reduce ruble revenues and tax receipts from raw material sectors. But artificial, `manual` weakening of the ruble through currency interventions, for example, could increase inflationary pressure. This is especially dangerous amid risks in the food and logistics markets. Therefore, the Central Bank`s approach – maintaining a market rate and intervening only during sharp fluctuations – seems justified. Incidentally, there was a lot of talk about ruble risks at SPIEF this year in general. This means that businesses feel difficulties and openly state them.»

«Currently, the ruble rate is based on the state of the trade balance, reduced imports, exporter activity during tax payments, and expectations regarding the key rate. The sanctions factor plays a role more in the long-term structure of currency supply and demand than in daily dynamics. It should be understood that with such stable currency supply and sufficiently weak imports, the dollar will likely remain within the 78-82 ruble range.»

«It could jump to 100 rubles during a systemic external shock – for instance, a new round of sanctions or a drop in oil prices. Without a stimulus of this magnitude, such levels are unlikely to be sustainable. The baseline scenario for the end of 2025 assumes the dollar rate remains in the 82-90 ruble range with moderate ruble weakening and the key rate remaining relatively high.»

«The current ruble strengthening indeed reduces exporters` revenues in ruble terms. Metallurgical and agricultural sectors feel this most strongly, where profitability is not as high. In the oil and gas sector, the effect is smoothed out by dividend payments and tax adjustments. Overall, the trend is painful for the budget.»